Board of Directors

Composition of the Board of Directors

The Nomination and Compensation Committee (NCC) strives to achieve a BoD composition with appropriate professional backgrounds and experience as well as diversity among the members of the BoD, including gender diversity and excluding age or tenure limitations.

During the reporting period, the following members formed part of the BoD. As at 31 December 2023, the BoD consisted of eight members.

|

Name |

Nationality |

Born |

First elected |

Significant shareholder |

Education |

Background |

|

|

|

|

|

|

|

|

|

Adam Warby Chair 1) |

British |

1960 |

2021 |

No |

Mechanical engineering |

Founder and former CEO, Avanade |

|

Daniel von Stockar 2) |

Swiss |

1961 |

2013 |

Yes |

Economics |

Entrepreneur, Founder SoftwareOne |

|

Peter Kurer 3) |

Swiss |

1949 |

2013 |

No |

Law |

Former Chair of Sunrise and UBS |

|

Marie-Pierre Rogers |

Spanish |

1960 |

2019 |

No |

Business |

Former Board Practice Leader, Spencer Stuart Switzerland |

|

Timo Ihamuotila |

Finnish |

1966 |

2019 |

No |

Economics and finance |

CFO, ABB Ltd |

|

José Alberto Duarte |

Portuguese |

1968 |

2019 |

No |

Accounting, management, marketing |

Former CEO, Infovista |

|

Isabelle Romy |

Swiss |

1965 |

2021 |

No |

Law |

Attorney, University Professor |

|

Jim Freeman |

American |

1972 |

2022 |

No |

Computer science and literature |

Former Chief Business and Product Officer, Zalando |

|

Elizabeth Theophille 4) |

British |

1967 |

2023 |

No |

Computer science and business administration |

Former Chief Technology Transformation Officer, Novartis |

1) Elected as Chair at the AGM on 4 May 2023.

2) Stepped down as Chair and member at the AGM on 4 May 2023.

3) Did not stand for re-election at the AGM on 4 May 2023.

4) Elected by the AGM held on 4 May 2023.

Individual Board members

External mandates

Availability and statutory provisions regarding external mandates

SoftwareOne’s AoI provide that the company’s BoD is composed of at least three and not more than 12 members, including the Chair of the BoD.

No member of the BoD may hold more than four additional mandates in listed companies and more than six mandates in non-listed companies.

Mandates within the meaning of this provision shall mean mandates of comparable functions at other companies with an economic purpose. Mandates in different legal entities under common control or owned by the same beneficial owner shall be deemed to constitute a single mandate.

The following mandates are not subject to these limitations:

- Mandates in companies which are controlled by the company or which control the company;

- Mandates held at the request of the company or companies it controls. No member of the BoD or of the EB may hold more than 10 such mandates;

- Mandates in associations, charitable organisations, foundations, trusts and employee welfare foundations. No member of the BoD or of the EB may hold more than six such mandates.

All members of the BoD remained within the statutory maximum numbers of outside mandates in listed and non-listed companies and organisations. The following table shows the attendance at meetings as well as outside mandates of the members of the BoD:

|

|

|

|

|

|

External mandates |

|

|

Name |

Board meetings |

Audit Committee meetings |

Nomination and Compensation Committee meetings |

Innovation Committee meetings 7) |

listed 8) |

non-listed 8) |

|

|

|

|

|

|

|

|

|

Adam Warby 1) |

8/8 |

|

5/6 |

|

1 |

3 |

|

Daniel von Stockar 2) |

4/8 |

|

4/6 2) |

1/2 2) |

0 |

2 |

|

Peter Kurer 3) |

3/8 |

|

4/6 3) |

|

0 |

1 |

|

Marie-Pierre Rogers |

8/8 |

|

6/6 |

|

0 |

0 |

|

Timo Ihamuotila |

8/8 |

6/6 |

|

|

1 |

1 |

|

José Alberto Duarte |

8/8 |

2/6 6) |

2/6 7) |

|

0 |

3 |

|

Isabelle Romy |

7/8 |

6/6 |

|

|

0 |

2 |

|

Jim Freeman |

8/8 |

6/6 |

|

2/2 |

0 |

3 |

|

Elizabeth Theophille 4)5) |

4/8 4) |

5/6 4) |

|

2/2 |

0 |

2 |

|

Average meeting length |

6:00h |

2:20h |

3:00h |

1:00h |

|

|

1) Elected Chair of the BoD at the AGM on 4 May 2023.

2) Stepped down as Chair of the BoD at the AGM on 4 May 2023. Daniel von Stockar no longer participated in BoD activities following the unsolicited takeover approach by Bain Capital, Daniel von Stockar and other shareholders.

3) Did not stand for re-election at the AGM on 4 May 2023.

4) Elected at BoD member at the AGM on 4 May 2023.

5) Attendance as a guest in the meetings that preceded the election at the AGM. Elected by the AGM held on 4 May 2023.

6) Until AGM on 4 May 2023.

7) From AGM on 4 May 2023.

8) Maximum number allowed in listed companies is four, and is six for non-listed companies.

Compensation of the Board of Directors

The shareholders’ meeting shall approve annually and separately the proposals of the BoD in relation to the maximum aggregate compensation of the BoD for the period until the next ordinary shareholders’ meeting. The compensation of the members of the BoD consists of an annual base fee and an additional compensation awarded for duties pursued in BoD committees as Chair or ordinary members. In line with Art. 18 of SoftwareOne’s AoI and to ensure the independence of the members of the BoD in executing their supervision duties, the compensation of the members of the BoD is in the form of a fixed amount (that is, no performance-related variable compensation component in place). Moreover, based on peer group and benchmarking as mentioned in the Compensation Report, it is in accordance with best market practice standards.

Effective from the 2020 AGM, the BoD’s total compensation is paid out 60% in cash and 40% in SoftwareOne shares. The shares allocated as part of the members of the BoD’s total compensation are blocked for a period of three years. Through the introduction of a share element, the long-term focus of the BoD in performing its duties is further strengthened and the interest further aligned with that of SoftwareOne’s shareholders. More details on compensation and post-employment benefits of the BoD can be found in the Compensation Report.

The members of the BoD may only be granted loans and credits up to a maximum amount of CHF 1,000,000 at market-based conditions and in compliance with the applicable rules of abstention. No loans were granted to the BoD members and no loans are outstanding.

Social security related payments on behalf of the BoD are limited to legal requirements.

Rules in the articles of association regarding compensation

Reference is made to the AoI and the Compensation Report regarding the additional amount for the compensation of members of the EB appointed after the vote of the AGM on compensation as well as to loans, credits and pension benefits of Board members and members of the EB, which follow the rules in the AoI concerning the principles on performance-related compensation and on the allocation of equity securities, conversion and option rights.

Environmental, Social & Corporate Governance (ESG)

SoftwareOne launched an ESG initiative in 2021 to realise the BoD’s ambitions for a sustainable future.

The ad hoc ESG Committee driving this initiative relies on the passion and commitment of the CEO, with the support of the ESG team.

Three employee-driven committees were created to focus on the vision, purpose, KPIs and strategy of the company’s ESG ambitions, offering accountability and ensuring a people-centric approach to the ESG strategy. These committees comprise employees from all regions and from vastly diverse teams, helping the company reach SoftwareOne employees globally, on a “glocal” basis, and allowing it to gather input from as many different employees as possible.

Lead stakeholders of all departments are instructed to involve colleagues in the ESG processes to support and embed the objectives into the business strategy. With the BoD oversight, senior leadership has full integration, visibility, and accountability over the ESG programme.

The details are further contained in the Non-Financial Report (NFR) 2023 of the Annual Report.

Interaction with shareholders and stakeholders

A key mandate of the BoD is to build and maintain an ongoing dialogue with its shareholders and other stakeholders. Engagement discussions with investors and proxy advisors outside financial and strategy matters such as governance, compensation and corporate social responsibility are steered by the Chair of the BoD or the Chair of the Nomination and Compensation Committee, supported by the Chief Legal Officer and the Chief Human Resources Officer or the Head of Group Compensation and Rewards.

Specific Board activities during the reporting period

The BoD meets at least six times per year (four quarterly report meetings, a strategy off-site, and a medium-term planning and budgeting meeting) and meetings are held in person but can also be held via telephone or video conference or by other electronic media. In 2023, the BoD held eight ordinary and, in the first half of the year, two extraordinary meetings. In the second half of the year, the BoD held extraordinary meetings every two weeks. Of the eight ordinary BoD meetings, one was held by video conference. The strategy meeting, also held in person, includes cultural aspects, including how to drive cultural change to foster overall good corporate governance. Further focus is placed on company performance and integrity as well as on company strategy and how to best incorporate and supply technological advances to the company and its customers. In addition, a call with the BoD members is held to approve the motions of the Audit Committee (AC) for the year-end reporting.

During the 2023 financial year, eight ordinary meetings of the BoD were held, with an average duration of approximately 6:00 hours. The average attendance at BoD meetings in 2023 was approximately 98% (for individual attendances, see section Availability and External mandates).

In addition to the regular meeting agenda items, in 2023 the BoD specifically focused on topics such as:

- Company target setting and achievement;

- "Ignite, Focus, Accelerate" strategy;

- Comprehensive strategy review upon receipt of an unsolicited takeover approach (as described in more detail below);

- Strategy and five-year business plan;

- Customer trends and new technologies, including generative AI products;

- Global talent succession planning;

- BoD assessment;

- ESG strategies and projects;

- Audit Committee, Nomination and Compensation Committee as well as Innovation Committee matters;

- Engagement with institutional investors, board participants and review of feedback received;

- Starting in July 2023, upon receiving an unsolicited takeover approach by Bain Capital, the BoD engaged in a comprehensive strategic review, in which it evaluated various options for value creation with its legal and financial advisors. Following a comprehensive due diligence process, the BoD received one non-binding value indication of CHF 18.80 per share from Bain Capital. After carefully reviewing the proposal, with the support of independent valuation and expert advice, the BoD unanimously agreed that the non-binding value indication neither provided sufficient certainty nor adequately reflected the fundamental value of SoftwareOne, and was therefore not in the best interest of the company and all stakeholders.

Board of Directors’ internal organisation

The legal foundation of the BoD’s responsibilities is provided by Art. 716a of the Swiss Code of Obligations.

The BoD has a supervisory role and takes strategy, finance and personnel decisions in accordance with the law, the AoI and the OrgR. It also supports, advises, and encourages management. The overall guiding principle for the BoD is full accountability to all shareholders and stakeholders of SoftwareOne and a style marked by a culture of openness and mutual respect.

The BoD has delegated certain responsibilities, including the preparation and execution of resolutions, to three committees. In addition, it drives the dialogue on general business and lends its full support, as well as also delegating responsibilities to the ad hoc ESG Committee. The responsibility for the duties and powers assigned to these committees is retained by the BoD.

The BoD has established the following three standing committees:

- Audit Committee (AC);

- Nomination and Compensation Committee (NCC);

- Innovation Committee (IC).

Each standing committee consists of a Chair and at least two other members of the BoD. The NCC consists of four members which are elected annually by the General Meeting of shareholders. The AC consists of four independent members that were appointed by the BoD and the IC consists of three members that were also appointed by the BoD. The duties and authorities of the committees are set forth in the Audit Committee Charter, the Nomination and Compensation Committee Charter and the Innovation Committee Charter, respectively, as well as in SoftwareOne’s OrgR. The committees’ operating principles are aligned with and complementary to those applicable to the overall BoD.

BoD committees are structured non-redundantly and working topics are clearly assigned and handled by only one committee. The BoD Chair coordinates committee work in case of potential overlaps. All materials used in BoD committee meetings are made available to all BoD members, who are invited to contact the committee Chair, the BoD Chair, or the CEO with any clarifying questions (exceptions may apply to materials of the NCC).

The BoD has established the additional key positions of Vice-Chair and Lead Independent Director, whose duties and competencies are described in the sections Vice-Chair of the Board of Directors and Lead Independent Director of the OrgR. The functions of the Vice-Chair and the Lead Independent Director can be combined and performed by the same BoD member. The Vice-Chair or Independent Lead Director will chair the Board and any general meeting in the absence of the Chair. With the appointment of an independent Chair at the AGM in 2023, the position of the Lead Independent Director was no longer required.

Chair of the Board of Directors

The Chair is entrusted with leading and managing the BoD and is responsible for establishing an appropriate structure and governance system that enables the BoD to render its duties efficiently and in the best interests of the company. The Chair encourages alternative views and constructive dissent, leveraging individual insights of BoD members while keeping the focus on the agenda topics and driving aligned decision-making.

The Chair further represents the opinions and views of the BoD towards SoftwareOne’s internal and external stakeholders. In exercising these duties, the Chair is guided by SoftwareOne’s conflict of interest policies and, if needed, will be supported by the Lead Independent Director.

In cooperation with the CEO, the Chair ensures that information flows on all aspects of the company which are relevant for the meeting preparation. Deliberations and decision-making are made available to all members of the BoD. In case of an emergency, when immediate action is required to safeguard the interests of the company, and where a regular BoD resolution cannot be reasonably passed in due time, the Chair, together with the CEO or any other appropriate member of the BoD or the EB, has the power to make all decisions and actions which otherwise would be reserved for the BoD. If the Chair is absent, this entitlement falls to the Vice-Chair or the Lead Independent Director. The Chair shall promptly inform all members of the BoD of such decisions and actions and they shall be confirmed and properly recorded in the minutes at the next meeting of the BoD.

The power and duties of the BoD Chair are set out in section 3.8 of the OrgR.

Vice-Chair of the Board of Directors

The Lead Independent Director (LID) assumed the role of the Vice-Chair until the AGM in 2023. With the election of an independent Chair of the BoD, the BoD decided that the position of LID was no longer required.

If the Chair is temporarily unable or unavailable to exercise the function, the Vice-Chair either personally assumes the Chair’s duties or delegates them within the BoD or to suitable company representatives.

The Vice-Chair has the right and duty to call meetings of the independent BoD members if they deem it necessary, especially when the independent decision-making process seems to be compromised. The Vice-Chair further acts as the point of contact for BoD members and investors if they have concerns with respect to the independent decision-making process.

The BoD further provides the independent BoD members under the lead of the Vice-Chair with financial resources to mandate external advice if this is deemed necessary by the Vice-Chair to foster independent decision-making of the BoD.

Moreover, the Vice-Chair supports the Chair in governance and strategy-related investor engagements. At the request of shareholders, the Vice-Chair would carry out these engagements without the Chair.

Lead Independent Director

The BoD assigns such powers and duties to the LID as it deems necessary (see section 3.10 of the OrgR). Until the AGM held on 4 May 2023, Peter Kurer was appointed as LID, who did not stand for re-election. Since that date, there has been no LID appointed.

Board of Directors’ independence assessment

The BoD generally defines the independence of its members within the meaning of the provisions of the Swiss Code. Accordingly, all non-executive members of the BoD who have never been a member of the EB (of the company or any direct or indirect subsidiary of the company), or who were members thereof more than three years ago, and who have no or comparatively minor business relations with the company (or any direct or indirect subsidiary of the company), are considered independent. Consequently, all members of the BoD are non-executive and considered independent according to the Swiss Code.

The BoD is committed to ensuring an independent decision-making process and is aware that BoD members representing large shareholders, even if they are the company’s founders who continue to contribute to its prosperous development, may be considered non-independent. Consequently, as long as one of the company's founders was the Chair of the BoD, a Lead Independent Director was appointed with far-reaching competencies, as well as independent Chairs to the Nomination and Compensation Committee and the Audit Committee. Through their casting votes, these two Chairs ensure the independent decision-making of both committees.

Independent decision-making/conflict management

The CEO, CFO and, as directed by the CEO, other EB members are required to attend meetings of the BoD to provide detailed information on the current state of the business and offer their views on strategic questions. EB members have no voting rights and will leave the room in case of discussions and/or decisions concerning the EB or their own position. A private meeting with BoD members will only be held before or at the end of each Board meeting. In 2023, a private meeting of the BoD members was held after every Board meeting.

In 2023, the CEO and the CFO participated in all eight (nine with the BoD call to approve the HY results) of the meetings of the BoD. The CEO informs the members of the BoD with regular updates about SoftwareOne’s business performance and about material events affecting the company. During BoD meetings, each director may request and receive information from other directors, the CEO, the EB and other persons present on all affairs relating to SoftwareOne or its subsidiaries.

In each regular BoD meeting, the Chairpersons of the AC, the NCC, the IC and the ad hoc ESG Committee will provide the BoD with an update of the committees’ work.

In case a member of the BoD requests information or, to the extent where it is necessary to perform their duties, examination of the business records outside of a meeting, such a request must be addressed to the Board Secretary and be approved by the Chair of the BoD. If the request concerns a potential conflict of interest for the Chair, it shall be addressed to the BoD for decision.

The BoD has the power to mandate external advisors if an outside view is deemed necessary for an independent decision-making of the BoD. Third parties (for example legal counsels, auditors or financial and other advisors) are admitted to BoD meetings on an exceptional basis if proposed by a BoD member or by the CEO or the Chief Legal Officer and approved by the Chair. In 2023, the BoD invited external experts to 19 of its meetings, the AC to six of its meetings and the NCC to one of its meetings. The IC did not invite external experts.

The agenda-setting for the BoD annual cycle and for individual meetings is the remit of the Chair. Meeting minutes reflect the deliberations and decisions taken by the BoD including, if requested, dissenting opinions of and votes cast by members of the BoD. The Board Secretary will make available to the members of the BoD a copy of the minutes once they have been signed. Members of the BoD may examine the minutes of any meeting at any time.

According to section 9 of the OrgR, each member of the BoD or the MB and any other executive body must conduct his/her personal and business/financial affairs in such a manner that conflicts with the interest of SoftwareOne are avoided. If there is the possibility of a conflict of interest, the person in question shall inform the Chair (or in case the conflict of interest is with the Chair, the Vice-Chair) in writing. The Chair (or in case the conflict of interest is with the Chair, the Vice-Chair) shall call for a decision by the BoD depending on the severity of the conflict. The BoD shall deliberate and decide in the absence of the person concerned. Daniel von Stockar no longer participated in board activities following the unsolicited takeover approach by Bain Capital and other shareholders, including himself, due to conflicting interests.

Board of Directors renewal and succession

The BoD must deliver its duties as a mutual decision-making body. Accordingly, the BoD must work as an efficient, effective, and aligned team. Succession planning and an active renewal process for the BoD is very relevant to the company. The requirements that prospective BoD candidates must meet in terms of knowledge and experience in various key areas and the industry are constantly changing and subject to increasingly higher demands.

The NCC regularly analyses the BoD’s composition to confirm that its members’ qualifications, skills, and experience correspond to the needs of the BoD, subject to an adequate Board size and well-balanced and diverse composition. A majority of the BoD members should be independent according to the criteria laid out in the section entitled “Board of Directors’ independence assessment”. Directors also need to show significant commitment, integrity, and competence in intercultural communication. Regarding its succession planning, the BoD aims to safeguard the stability of its composition while also renewing the BoD in a sensible way.

In line with the required skills and experience as detailed in the section “Board of Directors’ skill and experience assessment”, the NCC has developed a strategy to gradually develop the BoD composition to become more independent and proportionately reflect shareholdings. The BoD meets the gender representation requirements that demand a minimum 30% representation of each gender, which will be applicable by law from 1 January 2026.

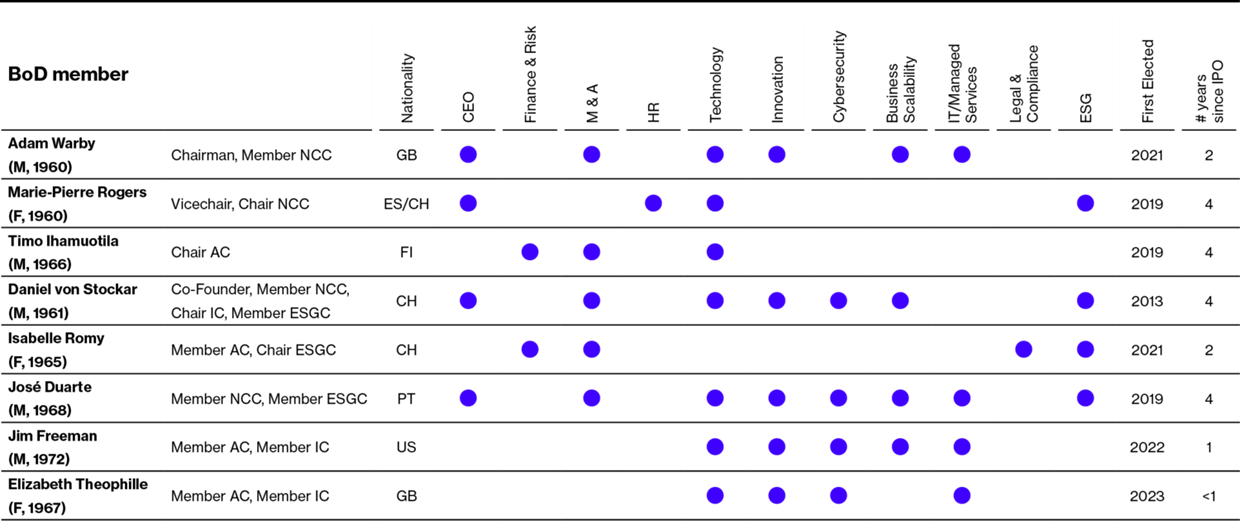

Board of Directors’ skill and experience assessment

To support the Board with its renewal and succession activities, the NCC established a skills and experience assessment that it conducts annually. The following competencies are considered the most relevant for SoftwareOne’s Board:

- Experience in the technology, IT/data and cyber security, and procurement industries;

- Finance, audit, accounting;

- Capital markets transactions;

- CEO and other executive leadership (CFO, CRO or COO) experience in a publicly listed or non-public company;

- Leadership experience as Chair of a Board of Directors or Board of Directors’ committee in a publicly listed or non-public company;

- Human resources management, including compensation;

- Leading business operations in a global and rapidly growing business;

- Governance, legal and compliance;

- Risk management and ESG;

- Artificial intelligence;

- Business and technology innovation.

The NCC reviews these competencies to confirm that the BoD continues to possess the most relevant experience and expertise to perform its duties, ensuring that the leadership of SoftwareOne has the relevant proficiency required for active involvement and supervision of an international listed company and applies these as guidelines when nominating new members.

The NCC updated its strategic skills matrix that focuses on aspects such as Board size, diversity, independence, nationality, committee representation and future skills needed to better understand the priorities for future Board recruitments. In terms of nationality, the Board agreed to preserve a good balance of ‘Swissness’, while seeking to move away from being chiefly Western European.

The strategic skills matrix reflecting the BoD composition as of December 2023 is as follows:

Board of Directors’ performance assessment

The BoD, in collaboration with the NCC, carries out a regular evaluation of the BoD’s and the BoD committees’ performance as well as the work of the Chair. To this extent, the BoD is committed to an open, transparent, and critical boardroom culture, which forms the basis for this annual review of its own performance and effectiveness.

The assessment is intended to review the BoD’s as well as the committees’ composition, organisation and processes, the BoD’s responsibilities governed by the OrgR and the committee charters. The committees shall further assess their accomplishments and evaluate their achievements subject to predetermined goals. The outcome of the evaluation will feed into the BoD’s succession planning as described in the section “Board of Directors’ skill and experience assessment.”

Coordinated by the Vice-Chair, an internal assessment of the BoD was performed during the reporting year.

Board of Directors’ training and education

Education is an important priority for SoftwareOne’s BoD. Newly elected BoD members attend an onboarding programme tailored to their functions to gain a sound understanding of SoftwareOne’s organisation, business, culture, and its environment. In addition to this induction programme for new members, refresher programmes are given to all Board members to update and enhance their knowledge of emerging business trends, risks, and legal framework. This is further intended to contribute to building a strong and effective culture in the BoD, which is an important pillar of its effectiveness.

Interaction of the Board of Directors with the Executive Board

In accordance with Art. 16 of the AoI and Art. 11.2 of the OrgR, the BoD has delegated the operational management of SoftwareOne and the group based on the OrgR entirely to the EB, within the limits permitted by and subject to the powers and duties remaining with the BoD pursuant to the OrgR.

The EB supports the BoD in fulfilling its duties and prepares proposals for consideration and decision-making by the BoD. These proposals are related to the following key group responsibilities: long-term strategy, business plan resilience, organisational structure, accounting principles, finance, capital markets, risk management including insurance, HR matters, corporate social responsibility, share capital and financing in general as well as for important strategic transactions. BoD resolutions shall result in appropriate feedback and unambiguous instructions to the CEO and other members of management.

The BoD supervises and monitors the performance of the EB through reporting and controlling processes. The CEO and other EB members regularly provide reports and updates to the BoD. These include information on key performance indicators and other relevant financial data, current and forward-looking risks and on developments in important markets, the industry and material events. The Chair of the BoD regularly meets with the CEO and other EB members outside of regular BoD meetings and individual BoD members will meet individual EB members with whom they are paired under a structured mentoring programme. SoftwareOne has an information and financial reporting system. The annual targets are reviewed by the EB in detail and are approved by the BoD. SoftwareOne has adopted and implemented a formal approach to risk management and control, described in more detail in the section Audit Committee.

The BoD remains entitled to resolve any matters which are not delegated to or reserved for the Annual General Meeting of shareholders or another executive body of the company by law, the AoI or the OrgR. Furthermore, the BoD may at any time on a case-by-case basis or according to a general reservation of powers provided in the OrgR, intervene in the tasks and powers of a subordinate EB and personally resolve the relevant matter.

Audit Committee

Key responsibilities and duties

The AC comprises at least three members of the BoD. As at 31 December 2023, the AC comprised four members. The members of the AC and the Chair are appointed annually by the BoD, which aims to appoint non-executive and independent (as defined in the Swiss Code) members of the BoD. The Chair of the AC must be an independent BoD member other than the Chair of the BoD. The members, including the Chair of the AC, should be experienced in financial and accounting matters. The term of office of the AC members ends at the closing of the next Annual General Meeting. Re-appointments are possible. The AC meets whenever required by the business, and at least four times per year.

The AC supports the BoD in the fulfilment of its duties as per Art. 716a CO in the areas of financial controls (supervision of internal and external auditing, monitoring of financial reporting), supervision of persons entrusted with the management of the group (assessing the effectiveness of internal and external control systems), risk management processes and oversight of key non-financial processes (corporate social responsibility and compliance). Its duties and responsibilities are set out in the AC Charter.

Audit Committee activities in the reporting period

In 2023, the AC held six meetings by video conference in February, May, June, August, November, and December, with an average duration of approximately 2:20 hours. The committee focused on several key areas, including but not limited to the activities described below. Specifically, the AC:

- Strategic review;

- Discussed the coverage of the group audit;

- Reviewed the risk map, including financing and forex risks, and internal and external audit plans;

- Reviewed the tax strategy and effective tax rate;

- Reviewed of treasury strategy, funding and capital structure;

- Reviewed the draft 2022 Annual Report and the draft 2023 Half-Year Report as well as the two draft quarterly trading updates in relation to the first and third quarter of 2023, respectively;

- Reviewed internal policies.

The AC sets the audit plan for a period of several years as well as the scope of the internal and external audits and approves the guidelines for the work of the Internal Audit department as well as for the company’s compliance organisation. It reviews and approves the internal and external audit plans, changes to the plans, activities, scope, and budget as well as accounting policies. The AC approves the fees for the external auditors. The AC challenges the appropriateness of risk-based estimates and judgements as well as the methods used to account for unusual transactions. Furthermore, the AC defines the organisational structure of the Internal Audit function and sets and reviews the qualifications of the Internal Audit organisation as deemed appropriate. The AC may hold meetings with representatives of the internal and external auditors without the presence of management. Such meetings must take place at least once per year with the external auditor. In 2023, the AC held three meetings with the internal auditors and six meetings with the external auditors.

It is the AC’s responsibility to assess the performance of the internal and external auditors as well as their cooperation with one another.

In consultation with management and the external and internal auditors, the AC discusses the integrity of SoftwareOne’s financial reporting processes, management controls, compliance management and the functionality of internal controls, reviews significant financial risk exposures and the steps taken by management to monitor, control and report such exposures.

The Head of Internal Audit and the Chief Legal Officer have a direct reporting line to the AC in case of significant compliance issues with the potential for major financial or reputational damage, including issues concerning management. The AC has direct access to the Internal Audit department and may obtain all information required from it, including direct access to employees. The AC will ensure that it receives regular information from both the internal and the external auditors. The AC has the overriding supervision of internal and external auditing.

Interactions with the Executive Board

The AC regularly invites the CEO, the CFO, and other members of the EB or, subject to prior notification of the responsible member of the EB, members of the company’s management or other key employees to its meetings, as deemed desirable or appropriate. Furthermore, upon invitation by the AC Chair or, in their absence, the member of the AC calling a meeting, other executive officers/employees of the company or its subsidiaries shall also participate in meetings of the AC on a consultative basis. Third parties may also be invited to participate in meetings of the AC on a consultative basis. In 2023, SoftwareOne’s CFO participated in all six AC meetings.

Risk management

The BoD is responsible for overseeing SoftwareOne’s risk management and internal control systems for which the BoD has mandated the AC. The AC monitors the strategic risk management processes and reviews the risk management framework against the company’s risk management strategy, providing recommendations and appropriate mitigations. It further assesses the robustness of the company’s risk management policies and processes related to the risk management strategy. These systems provide appropriate security against significant inaccuracies and material losses.

Risks are identified through a variety of methods, including a formal enterprise risk assessment. This assessment considers whether key (emerging) risks that could impact the achievement of SoftwareOne's strategic objectives are appropriately managed.

The assessment results are included in a risk register, which considers the gross risk (without mitigation measures) and the net risks (with and without mitigation measures including controls). An internal controls system is in place for financial risks, whereby control owners have to attest to the effectiveness of their controls and provide supporting evidence. The updated risk register is discussed and reviewed with the Audit Committee at least once per year.

Throughout the year, SoftwareOne continued to invest in its risk management approach. This included strengthening the second line function by appointing a new Head of Financial Internal Controls as well as a new Head of Internal Audit.

The company applies a three-line defence model to ensure effective risk management is in place.

First line:

- Leaders and staff who are responsible for identifying and managing risk as part of their accountability to achieve objectives.

- Effective internal controls on day-to-day processes.

Second line:

- Functions overseeing or specialising in compliance or risk management.

- Policies, frameworks, tools, techniques, and other support to enable effective risk and compliance management.

Third line:

- Internal audit function and the external auditors provide independent and objective assurances, and consulting services.

- Reports to Audit Committee with risk-based approach, evaluating the design and operating effectiveness of policies, procedures, and controls.

- Scope: enterprise-wide, including finance, operations, and technology.

Based on its risk management oversight activities, the AC makes proposals to the BoD regarding the company’s corporate governance, compliance, and corporate responsibility framework. The AC also assesses the effectiveness of the internal control system related to key financial processes, forms a view on the situation concerning compliance with applicable standards and guidelines, and develops these further.

Embedded throughout the business, the group risk management function ensures an integrated approach to managing current and emerging threats. Risk management plays a key role in business strategy and planning discussions. At SoftwareOne, the group risk management function falls under the responsibility of the CFO.

Strategic risk management has identified key areas of risks that are constantly monitored by group risk management and the AC. The following key strategic risk categories have been identified:

Strategic business risks, e.g.:

- Economic crisis;

- Significant losses of the value chain in software & cloud;

- Slow innovation;

- Unsuccessful new service models;

- Slow multivendor model adoption;

- ESG risks, as reported by the ad hoc ESG Committee.

Operational risks, e.g.:

- IT security, including cyber and data;

- IT applications;

- Customer security breaches in cloud consumption;

- Operational excellence issues (scalable and efficient business model).

Financial risks, e.g.:

- Unhedged market risk;

- Accounts receivable risk;

- Currency fluctuation risk;

- Transfer pricing;

- Tax risks;

- Performance measurement and controlling.

Legal and compliance risks, e.g.:

- Non-conformity, illegal acts, internal or external fraud;

- Reputational risk;

- Professional liabilities with service business;

- Non-compliance with laws and regulations, including stock market regulations;

- Internal or external fraud.

Risk management is carried out by line management, controlled by the CFO under policies approved by the BoD and reviewed and supervised by the AC. Key risks are identified, evaluated, and managed in close co-operation with the group’s operating units. The BoD provides written principles for overall risk management, as well as written policies covering specific areas within the risk categories.

The company’s risk management system covers the processes of the entire application management of all local and global IT systems, and ensures a regular monitoring as well as update of its IT systems and processes to ensure reliability, business continuity and performance.

SoftwareOne is certified to international standards on systems management, including ISO 9001:2015 on quality management systems, ISO 14001:2015 on environmental management systems. and ISO/IEC 27017:2015 for Brazil and India on information security controls for cloud services.

Quality audits are an integral part of SoftwareOne’s quality management system and cover the control of the established processes to fulfil all required regulatory industry standards.

The AC periodically monitors SoftwareOne’s risk assessment and assesses the proposed risk mitigation measures proposed by the EB on at least an annual basis.

Audit of non-financial and ESG topics

A key non-financial risk for SoftwareOne is IT security. Therefore, the assessment of performance against an IT security framework is an important ongoing task for Internal Audit. To ensure that the appropriate specialists in Internal Audit can conduct their assessments according to the highest and most recent industry standards, SoftwareOne provides relevant training and resources required by Internal Audit.

A material component of an ESG programme was the definition of new targets and their validation against recognised reporting standards. These were published in the SoftwareOne ESG report in H2 2023, outlining SoftwareOne’s ambitions and the targets to be used, as recognised reporting standards. The progress against agreed ESG targets will be regularly monitored by Internal Audit.

Nomination and Compensation Committee

Key responsibilities and duties

As at 31 December 2023, the NCC comprised four members. The members of the NCC are each elected annually and individually at the shareholders’ meeting. Their term of office ends at the closing of the next ordinary shareholders’ meeting and re-election is possible. The Chair of the NCC is appointed by the BoD. In any case the Chair of the NCC shall be an independent member of the BoD and there shall be an independent majority in the NCC (with the casting vote of the Chair).

If there are vacancies in the NCC, the BoD may appoint substitute members from among its members for a term of office extending until the closing of the next ordinary shareholders’ meeting. The NCC meets whenever required by business, and at least three times per year.

The NCC has the powers and duties of the compensation committee as provided by Swiss law and in particular, the Ordinance against Excessive Compensation in Public Companies, as well as the powers and duties as provided in Art. 15 para. 5 of the AoI and the NCC Charter. The overall responsibility for the duties and powers assigned to the NCC shall remain with the BoD. The NCC shall regularly report to the BoD on its activities and submit the necessary proposals. Details of the compensation policies and principles can be found in the Compensation Report 2023.

Nomination and Compensation Committee activities in the reporting period

The NCC held six meetings in 2023, all but one by video conference. The average duration of these calls was approximately 3 hours. The committee focused on several key areas, including:

- Providing guidance on composition and succession planning of the BoD and the EB;

- Appointing a new CEO;

- A compensation framework including compensation levels and benchmark analysis for the EB and BoD;

- Preparing compensation decisions, including the setting of short-term incentive and long-term incentive targets, short-term incentive pay-outs, long-term incentive grants and salaries for EB members;

- Diversity review;

- EB succession planning;

- External mandates review.

The NCC’s work on compensation-related matters is described in detail in the SoftwareOne Compensation Report.

Nomination and Compensation Committee interactions

The NCC shall regularly invite the CEO to its meetings and may invite other members of the EB or, subject to prior notification of the responsible member of the EB, members of the company’s management, as it deems desirable and appropriate to fulfil its tasks responsibly.

The CEO or other members of the EB may not be present when the NCC reviews the compensation or other aspects of the employment of the relevant person. The Chair of the BoD or the NCC Chair is not present when the NCC reviews their compensation. In 2023, the CEO participated in five of the six meetings of the NCC. The NCC regularly consults the Chief Human Resources Officer to develop and recommend appropriate actions to the BoD.

In the process of evaluating SoftwareOne’s performance against the pre-determined compensation-relevant performance metrics, the NCC generally interacts annually with the Chair of the AC to obtain the information on the relevant metrics.

To further develop the compensation system, namely the Short- and Long-Term Incentive schemes reviews, the NCC worked together with external service providers HCM Hostettler & Company (HCM), Mercer and Willis Towers Watson. These were the only business relationships and mandates of SoftwareOne with Mercer and HCM. Willis Towers Watson was mandated with a human resources project.

Innovation Committee

Key responsibilities and duties

As at 31 December 2023, the IC comprised three members. The members of the IC and the Chair are appointed annually by the BoD. Their term of office ends at the closing of the next ordinary shareholders’ meeting and re-appointment is possible. The IC meets whenever required by business, and at least four times per year.

The IC supports the BoD in identifying and assessing existing and future trends and technologies, determining how these may affect the company’s operations and whether they offer new business opportunities. The IC assists the BoD in matters relating to long-term transformational challenges, business development, innovation and plans as developed by the company. Its duties and responsibilities are set out in the IC Charter.

Innovation Committee activities in the reporting period

In 2023, this being the year of its creation at the AGM in May, the IC held two meetings in 2023, both by video conference. The average duration of these calls was approximately 1 hour. The committee focused on several key areas, including:

- Providing guidance on innovation, technology, and digital transformation;

- Promoting innovation initiatives that support business growth;

- Assessing the company’s identification, research and integration of technology and innovation;

- Reviewing strategic vendor partnerships relating to technology innovation;

- Reviewing the company’s risk posture and exposures relating to technology development;

- Overseeing the company’s business continuity, contingency, and recovery plans for technology, systems and data.

Innovation Committee interactions

The IC shall regularly invite the CEO and the Chief Information Officer to its meetings and may invite other members of the EB and members of the company’s management, as it deems desirable and appropriate to fulfil its tasks responsibly.

Furthermore, upon invitation by the IC Chair or, in their absence, the member of the IC calling a meeting, third parties may also be invited to participate in meetings of the IC on a consultative basis.