Executive Board compensation

Elements of compensation

The following section outlines SoftwareOne’s compensation framework for 2023. It was amended after extensive review by the NCC and its external advisors following the IPO in 2019 and further refined thereafter. We are convinced that a continuous review of this framework by the NCC enables a proper fit to the corporate culture, goals, and strategic ambitions of SoftwareOne in an ongoing volatile environment.

The compensation framework for members of the EB consists of fixed and variable compensation elements. The fixed compensation element comprises a base salary as well as pension and other benefits (e.g. car allowances). The variable compensation element consists of a Short-Term Incentive (STI) plan and a Long-Term Incentive (LTI) plan. The payout or vesting of variable compensation elements is subject to performance including SoftwareOne share performance, financial and strategic successes, and ESG progress. The EB compensation elements are summarised in the following table:

|

|

Fixed compensation elements |

Variable compensation elements |

||

|

ELEMENTS OF COMPENSATION |

Base salary |

Pension and other benefits |

Short-Term Incentive plan |

Long-Term Incentive plan |

|

Purpose |

Attract, retain and reward the roles and responsibilities of respective functions |

Participation in pension, insurance care plans and additional benefits in line with local market practice |

Motivation and reward for annual objective achievements (company and individual goals) |

Participation in the long-term success of SWO and alignment with shareholder interests |

|

Performance period |

– |

– |

One year |

Three years |

|

Performance measures |

– |

– |

Revenue growth, EBITDA margin, ESG and strategic goals |

Revenue growth, EBITDA margin and relative total shareholder return (TSR) |

|

Payout range |

– |

– |

0 to 200 % of target STI |

0.0 to 2.0 times number of granted performance share units (PSUs) |

|

Payment |

Cash |

Contributions to pension and insurance plans |

Cash |

Shares |

|

Other benefits paid out in cash |

||||

Fixed compensation elements

Base salary

The base salary for members of the EB is typically paid in cash on a monthly basis unless local laws require otherwise. The base salary amount is defined according to market practice and the responsibility, experience, and achievements of each member.

Pension and other benefits

Pension benefits are provided through SoftwareOne’s regular pension plan. As the EB members reside in different international locations, some EB members are employed under a foreign employment contract and receive benefits in line with current local market practice. In addition to pension coverage, other benefits such as health care plans, insurance, car allowances or equivalent contributions are also covered. These allowances are paid together with the EB members’ base salary and are in line with the company policy in the local jurisdiction.

Furthermore, new members joining the EB may receive compensation for the loss of their remuneration or for financial disadvantages incurred as a result of changing their jobs. If applicable, such lost compensation is replaced on a like-for-like basis (i.e. no increase in replacement value) and reported in the compensation table for the relevant reporting period under "Other benefits".

Variable compensation elements

Short-Term Incentive (STI) plan

The STI rewards the overall company performance and the EB members’ individual contribution to the success of SoftwareOne in line with the compensation principle of pay-for-performance. The plan is determined by the achievement of financial goals (weighted at 70%) and strategic goals (weighted at 30%). As of 2023, financial goals are determined on the basis of revenue growth and EBITDA margin. Strategic goals comprise objectives in the areas of ESG, including disclosure and reporting (e.g., Non-Financial Report, Carbon Disclosure Report), CO2 reductions (e.g., travel-related), gender diversity (e.g., increase in female leadership representation, “Women Academy”), and succession planning (e.g., people review and succession planning for EEB) as well as strategic ambitions to drive business growth and operational excellence. The latter are determined for each EB member and address their individual functional duties and responsibilities.

The table below illustrates the details on the STI performance metrics in terms of definition, weighting, and payout range for the CEO and the other EB members:

1) For the purposes of the STI, ‘Revenue’ is measured in constant currency and defined as gross sales of services and software deducted from the cost of purchasing software.

2) For the purposes of the STI, EBITDA margin means the adjusted EBITDA margin as disclosed in the Annual Report and ‘EBITDA‘ being defined as earnings before interests, tax depreciations and amortisations.

At the end of the performance period, the NCC proposes and the BoD approves the financial performance achievements and ESG progress against the set group targets. EB members' individual contributions to SoftwareOne's success, as measured by the achievement of strategic goals, are initially evaluated by the CEO, reviewed by the NCC, and approved by the BoD, while the achievement of strategic objectives established for the CEO is evaluated by the NCC and approved by the BoD. Under specific circumstances, the BoD may apply discretion in interpreting the NCC’s recommendation regarding the final STI payout.

Relevant performance achievements and the resulting STI payout factor for the financial year 2023 are reported in section STI 2023. The payout of the STI is made entirely in cash.

Long-Term Incentive (LTI) plan

SoftwareOne’s compensation framework is completed by an equity-based element which was introduced in 2020. It offers executives and selected senior managers the opportunity to participate in the long-term success of the group. The goal of this plan is to provide eligible participants with attractive, market-aligned rewards to strengthen management’s interest alignment with those of shareholders and to encourage sustainable long-term value creation for shareholders and the company.

At the beginning of each three-year performance period (i.e. at grant date), eligible participants are granted an individual number of performance share units (PSUs) derived by dividing the individual LTI award (in CHF) by the fair value at grant (in CHF). After the conclusion of the three-year performance period, the PSUs vest subject to performance and service conditions.

The performance condition is based on three metrics: revenue growth, EBITDA margin and relative total shareholder return (rTSR). The vesting range lies between 0.0 and 2.0 times the PSUs granted at the outset. While low performance in one performance metric can be balanced by a higher performance in another metric, the combined vesting multiple can never exceed 2.0. On the contrary, if performance of all metrics remains below the respective minimum performance thresholds, the resulting combined vesting multiple would be 0.0 and consequently no PSUs would vest.

At the beginning of each performance period, the BoD determines the minimum, low threshold, target, high threshold and maximum for each LTI performance metric upon the NCCs recommendation. The latter is supported by the comprehensive evaluation process, which takes into account the current strategic performance aspirations and the general market situation. We deem absolute targets for the revenue growth and EBITDA margin metric to be commercially sensitive and confidential strategic information and hence disclose these on a relative basis to avoid unfair competitive disadvantage for SoftwareOne.

The overall vesting factor is the sum of the weighted vesting factor metrics and is determined at the end of the three-year performance period. The NCC proposes and the BoD approves the performance achievement of each metric against the targets originally set as well as the overall vesting factor.

In case of a change of control, the LTI plan will terminate with effect from the date of the change of control unless otherwise decided at the discretion of the BoD.

Risk-alignment under variable compensation plans: clawbacks and forfeitures

Under the STI, in case of termination of employment during the performance period, the payout may be reduced or forfeited depending on the conditions of such termination and subject to the applicable law. Under the LTI, a service condition requires continuous employment of the plan participant until vesting. In case of termination of employment, either none or a reduced number of PSUs vest depending on the conditions of such termination and subject to the applicable law.

As of 2021, a clawback provision, which allows for a partial or full recovery of equity allocated to EB members under the Long-Term Incentive plan was introduced. This applies in specific situations which may cause reputational damage to the group, in case of restatements of previously audited consolidated financial statements for example or which may otherwise negatively affect the legitimate interests of SoftwareOne. This provision was also expanded in 2023 to cover the Short-Term Incentive Plan.

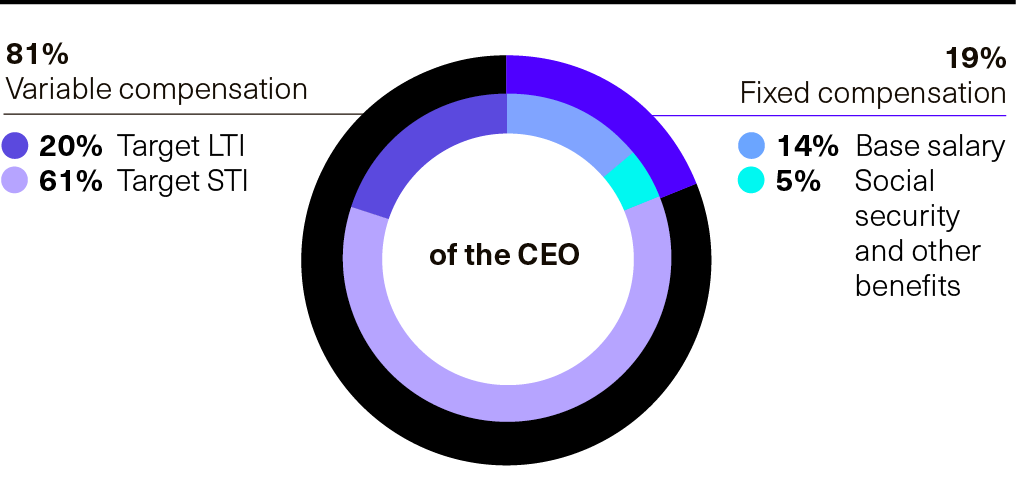

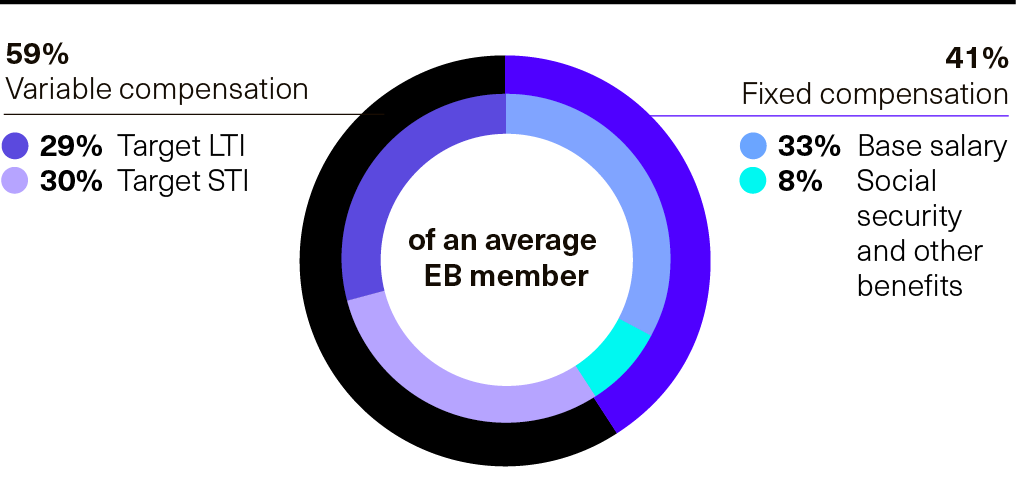

Compensation mix

In 2023, the total target compensation of the CEO was split into around 81% variable compensation and 19% fixed compensation. Of the 81% variable target compensation portion, 20% consisted of the target STI and 61% of the target LTI portion. For other EB members excluding the CEO, the fixed compensation was on average 41% (37% - 55%) and the variable compensation 59% (45% - 63%). The variable target compensation consisted of 29% (24% - 45%) target STI and 30% (0% - 39%) target LTI of total target compensation.

Target compensation mix

Compensation awarded to the EB in 2023

The following table outlines details concerning the compensation awarded to the CEO as the highest-paid member of the EB and to the other EB members from 1 January to 31 December 2023. The total compensation awarded in 2022 is also listed.

|

Audited in CHF |

Fixed compensation |

Variable compensation |

Total compensation FY 2023 (5) |

Total compensation FY 2022 |

|||

|

Base salary |

Social security contributions |

Other payments (3) |

Realised STI |

Awarded LTI grant value (4) |

|||

|

Brian Duffy, CEO (1) |

633,336 |

155,712 |

136,325 |

950,000 |

2,850,000 |

4,725,373 |

2,585,771 |

|

Aggregate amount of EB members excluding Brian Duffy (2) |

2,767,450 |

208,688 |

404,923 |

1,756,761 |

2,533,335 |

7,671,157 |

6,112,568 |

|

Total |

3,400,786 |

364,400 |

541,248 |

2,706,761 |

5,383,335 |

12,396,530 |

8,698,339 |

1) Brian Duffy joined SoftwareOne as CEO effective 01 May 2023. Base Salary and target STI were pro-rated accordingly. The LTI was granted in full, given the timing of the annual LTI grant and the forward-looking nature of the instrument. In total, the cost incurred by LTI for shareholders remained unchanged given the forfeitures of the prior CEO.

2) Please note that of the five EB members, one is compensated in USD (average exchange rate in 2023 of CHF 1 to USD 1.1136 applied), one in SGD (average exchange rate in 2023 of CHF 1 to USD 1.4955 applied) and the three other EB members in CHF.

3) Other payments comprise payments related to non-compete agreements and further benefits granted (e.g. insurance, car allowance, pension).

4) For details regarding the grant logic and the calculation of the fair value at grant date refer to the financial notes.

5) Numbers include Dieter Schlosser, who who was active as the CEO until 31 April 2023 with the employment relationship ending 31 October 2023, followed by a non-compete period. He receives pro-rated base salary and STI for 2023 but no LTI allocation.

Approved versus total compensation awarded to the EB

The total compensation for the EB for 2023 of CHF 12.4 million (including social security contributions) is below the total maximum aggregate compensation amount of CHF 15.5 million, which was approved by the AGM in May 2022.

STI 2023: target setting, performance achievement, and payout

At the beginning of the one-year performance period, the NCC proposes, and the BoD approves, the minimum, target, and maximum achievement for the respective performance metrics under the STI. For performance below or at the minimum, 0% is paid out. On-target performance is rewarded with a 100% payout. In case of overperformance, up to 200% can be achieved when meeting the maximum. This means that the payout curves for both financial KPIs are linear and symmetrical. In terms of revenue, growth was 7.7% year on year in constant currency in 2023. In the context of STI 2023, this resulted, however, in the underachievement of the minimum performance level.

Regarding the EBITDA margin, the actual achieved performance in 2023 was 25.3%, driven by operational excellence and margin progression in Software & Cloud Services. We also delivered on our operational excellence programme, exceeding our cost savings target, and increasing our annualised savings target for 2024.

For 2023, ESG progress was measured in the areas of disclosure and reporting, CO₂ reduction, and diversity with a focus on gender. In this area, we achieved a double-digit increase in female representation among the leadership team and launched multiple initiatives, including SOAR – a program to support women returning to the workplace. We also introduced Amplify – an alumni programme, as well as succession planning where we implemented a structured assessment process for EB and EB-1, resulting in a complete assessment of all EB members and their potential successors. The individual contribution of EB members to SoftwareOne's success, as measured by the achievement of strategic goals to drive business growth and operational excellence, was above target overall.

During 2023, we streamlined our organisational set-up, aligned our leadership structure and implemented an effective Strategic Review Process. We introduced new communication structures, progressed on operational excellence, particularly regarding cost savings and EBITDA margin, further rejuvenated our portfolio offering and transformed multiple teams to fit the new business model.

The overall 2023 STI performance achievements resulted in the final STI payout factor of 65% - 76% for full-year EB members or members who left during 2023. For members of the EB who joined during 2023, the STI performance achievement covers the period since joining SoftwareOne. In view of their short tenure, an abbreviated assessment focusing on individual contributions to the company's success is carried out. This applies also to the CEO, for whom the STI payout factor was set at 100% for 2023, since he joined in May 2023.

LTI 2023 – 2026: Target setting

At the beginning of each performance period, the BoD determines the minimum, target, and cap for each LTI performance metric upon the NCC's recommendation to be achieved on average over the three-year performance period. The target setting is supported by the comprehensive evaluation process, which takes into account the current strategic performance aspirations and the general market situation.

We deem absolute targets for the revenue growth and EBITDA margin metric to be commercially sensitive and confidential strategic information, especially because the plan is still running until 2026. Therefore, we disclose these on a relative basis to avoid unfair competitive disadvantage for SoftwareOne. To provide some reassurance to our shareholders regarding the ambition included in our target-setting process, we describe our target-setting process in more detail below and provide transparent insights into the target achievements retrospectively.

For our operational metrics revenue growth and EBITDA margin, targets were set based on the strategic plan as well as the guidance provided to our external investors and requiring continuous year-on-year performance improvements. For performance below or at the minimum, 0% is paid out. For the revenue growth metric, the minimum reflects 80% of the target, for the EBITDA margin, the minimum is set at 92% of the target. On-target performance is awarded with a 100% payout. In case of overperformance, up to 200% can be achieved when meeting the cap of 120% of the target for the revenue growth metric and 108% for the EBITDA margin.

For our stock market linked KPI, relative TSR, the minimum, target and cap remained unchanged compared to the prior year and are disclosed in the graph below.

The minimum, target and caps for all metrics that are driving the vesting factor for our LTI are symmetrical and calibrated in a way to balance sustainable performance below and above the target and, based on statistical methods, reflect a realistic realisation of performance-based pay.

The following illustration outlines the minimum, target, and cap for the respective metrics:

LTI 2020-2023: performance achievement and vesting

In 2023, the first vesting of SoftwareOne’s LTI plan took place, it was established right after the listing of SoftwareOne on the SIX Stock Exchange and granted in 2020.

For this grant, performance was measured based on two metrics: gross profit and relative TSR. Performance under the gross profit performance metric was excellent, leading to a vesting multiple of 1.49. However, the very favourable outcome in terms of operational excellence was not reflected in our share price and therefore a vesting multiple of 0.00 for the second LTI metric, relative TSR. Overall, the total weighted vesting factor of the LTI 2020 – 2023 is 1.12.

Given the changes to our Executive Board since the grant in 2020, leading to certain forfeitures of PSUs, the total number of PSUs that vested in 2023 amounts to 293’696.

Share ownership

In 2021, we introduced ownership requirements for the EB members with a five-year build-up period. The minimum shareholding requirement level was set at 300% and 200% of base salary respectively for the CEO and EB members.

The table below shows the shareholdings of each EB member as of 31 December 2023, considering the number of directly held shares and restricted shares. The total shareholdings as of 31 December 2022 are also listed:

|

Audited EB members |

Total shareholdings as at 31 December 2023 |

Total shareholdings as at 31 December 2022 |

|

Brian Duffy (1) |

– |

– |

|

Neil Lomax (2) |

783,963 |

892,948 |

|

Bernd Schlotter |

33,000 |

33,000 |

|

Rodolfo Savitzky |

53,340 |

53,340 |

|

Julia Braun |

– |

– |

|

Dieter Schlosser (3) |

– |

918,788 |

|

Alex Alexandrov (4) |

– |

758,626 |

|

Total |

870,303 |

2,656,702 |

1) Brian Duffy joined SoftwareOne effective 01 May 2023.

2) Shareholdings as of 31 December 2023 include also shareholdings from related party.

3) Dieter Schlosser resigned from the EB effective 31 October 2023.

4) Alex Alexandrov resigned from the EB effective 31 December 2022.

Further compensation information

Employment agreements

All members of the EB have employment contract agreements with a six-to-twelve month notice period, which are governed by the applicable laws. They are not entitled to severance payments.

Their employment agreements also prohibit the EB members from competing against SoftwareOne for a period of up to twelve months after termination of their employment contract. For the specified non-competitive period, SoftwareOne agrees to pay a compensation to the EB member for their compliance with this non-competitive undertaking to an amount equal to 80% of their last base salary (excluding any ancillary benefits and subject to deduction of any social security and further deductions). This is payable in arrears in monthly instalments, for as long as the EB member complies with the non-competitive agreement. However, SoftwareOne may at any time up to two months prior to the last day of employment, waive compliance with the non-competitive agreement whereupon such payments will no longer be due.

Payments to current or former members of the Executive Board

In relation to 2023, payments of CHF 200.000 (including social contributions) were made to the former EB member Hans Grueter. No further payments other than those set out in the compensation table for EB members were made to current or former EB members or "closely related persons".

Loans to members of the Executive Board

Article 23 of SoftwareOne’s Articles of Incorporation allow for loans and credits of up to CHF 1 million at market-based conditions to be granted to EB members. In 2023, no loans or credits were made to EB members.