Executive Board compensation

Elements of compensation

The following section outlines SoftwareOne’s compensation framework for 2022. It was amended after extensive review by the NCC and its external advisors following the IPO in 2019 and further refined thereafter. We are convinced that a continuous review of this framework by the NCC enables a proper fit to the corporate culture, goals, and strategic ambitions of SoftwareOne in an ongoing volatile environment.

As of 2022, the compensation framework for members of the EB consists of fixed and variable compensation elements. The fixed compensation element comprises a base salary as well as pension and other benefits (e.g., car allowances). The variable compensation element consists of a Short-Term Incentive (STI) and a Long-Term Incentive (LTI) plan. The payout or vesting of variable compensation elements is subject to performance including SoftwareOne share performance, financial and strategic successes, and ESG progress. The EB compensation elements are summarised in the following table:

|

|

Fixed compensation elements |

Variable compensation elements |

||

|

ELEMENTS OF COMPENSATION |

Base salary |

Pension and other benefits |

Short-Term Incentive plan |

Long-Term Incentive plan |

|

Purpose |

Attract, retain and reward the roles and responsibilities of respective functions |

Participation in pension, insurance care plans and additional benefits in line with local market practice |

Motivation and reward for annual objective achievements (company and individual goals) |

Participation in the long-term success of SWO and alignment with shareholder interests |

|

Performance period |

– |

– |

One year |

Three years |

|

Performance measures |

– |

– |

Gross Profit, EBITDA margin, ESG and strategic goals |

Gross profit and relative total shareholder return (TSR) |

|

Payout range |

– |

– |

0 to 150 % of target STI |

0.0 to 2.0 times number of granted performance share units (PSUs) |

|

Payment |

Cash |

Contributions to pension and insurance plans |

Cash |

Shares |

|

Other benefits paid out in cash |

|

|

||

Fixed compensation elements

Base salary

The base salary for members of the EB is typically paid in cash on a monthly basis unless local laws require otherwise. The base salary amount is defined according to market practice and the responsibility, experience, and achievements of each member.

Pension and other benefits

Pension benefits are provided through SoftwareOne’s regular pension plan. As the EB members reside in different international locations, some EB members are employed under a foreign employment contract and receive benefits in line with current local market practice. In addition to pension coverage, other benefits such as health care plans, insurance, car allowances or equivalent contributions are also covered. These allowances are paid together with the EB members’ base salary and are in line with the company policy in the local jurisdiction.

Further, pursuant to Article 20 of the Articles of Incorporation, new members joining the EB may receive compensation for the loss of their remuneration or for financial disadvantages incurred because of changing their jobs. If applicable, such lost compensation is replaced on a like-for-like basis (i.e., no increase in replacement value) and reported in the compensation table for the relevant reporting period under “Other benefits”.

Variable compensation elements

Short-Term Incentive plan

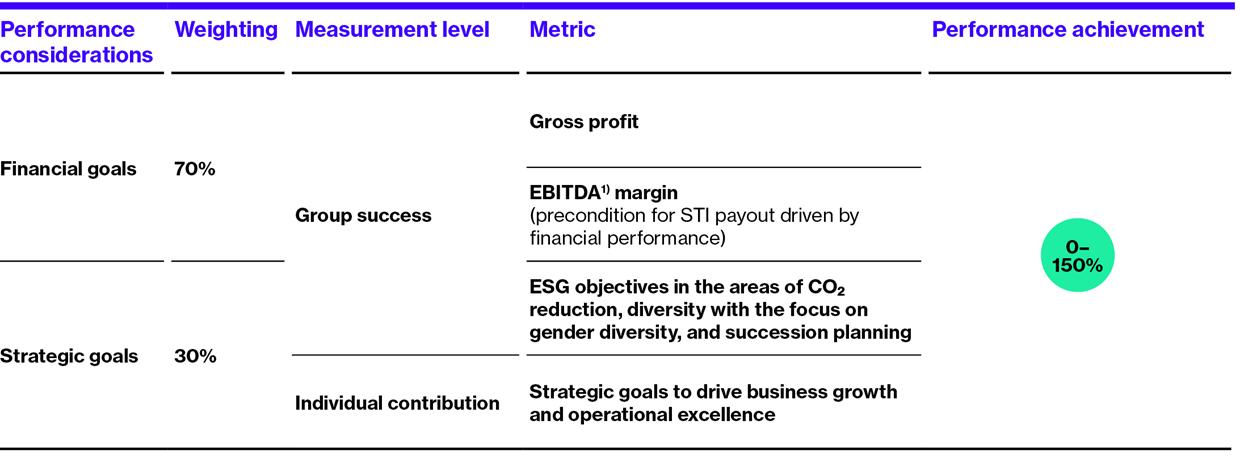

The STI compensation elements of the EB reward the overall company performance and the EB members’ individual contribution to the SoftwareOne success in line with the compensation principle of pay-for-performance. The plan is determined by the achievement of financial goals (weighted at 70%) and strategic goals (weighted at 30%). Financial goals are determined based on gross profit and EBITDA margin, with the achievement of a predefined EBITDA margin threshold being a prerequisite for the STI payout, which depends on financial performance. Strategic goals comprise ESG objectives in the areas of CO2 reduction, diversity (with an additional focus on gender diversity), succession planning and strategic ambitions to drive business growth and operational excellence. The latter are determined for each EB member and address their individual functional duties and responsibilities.

The table below illustrates the details on the STI performance metrics in terms of definition, weighting, and payout range for the CEO and the other EB members:

Performance achievement across STI goals

1) 'Adjusted EBITDA' is defined as the underlying like-for-like earnings before interests, tax, depreciation and amortisation including one-time specific adjustments in operating expenses.

At the beginning of the one-year performance period, the NCC proposes, and the BoD approves the minimum, target, and maximum achievement for the respective performance metrics. For performance below or at the minimum, 0% is paid out, whereby on-target performance is awarded with a 100% payout. In case of overperformance, up to 150% can be achieved. The required achievement levels are derived from the company’s strategic business plan and aligned with a robust budget for the respective year. As these represent commercially sensitive information, no details on the required achievement levels are disclosed. Relevant performance achievements and the resulting STI payout factor for the financial year 2022 are reported on page 88. At the end of the performance period, the NCC proposes, and the BoD approves the financial performance achievements and ESG progress against the set targets. EB members' individual contributions to SoftwareOne's success, as measured by achievement of strategic goals, are initially evaluated by the CEO, reviewed by the NCC, and approved by the BoD, while the achievement of strategic objectives established for the CEO is evaluated by the NCC and approved by the BoD. Under specific circumstances, the BoD may apply discretion in interpreting the NCC’s recommendation regarding the final STI payout. The payout of the STI is made entirely in cash.

In case of termination of employment during the performance period, the payout of the STI may be reduced or forfeited depending on the conditions of such termination and subject to the applicable law.

Long-Term Incentive plan

SoftwareOne’s compensation framework is completed by an equity-based element which was introduced in 2020. It offers executives and selected senior managers the opportunity to participate in the long-term success of the group. The goal of this plan is to provide eligible participants with attractive, market-aligned rewards to strengthen management’s interest alignment with those of shareholders, and to encourage sustainable long-term value creation for shareholders and the company.

At the beginning of each three-year performance period (i.e., at grant date), eligible participants are granted an individual number of performance share units (PSUs) derived by dividing the individual LTI award (in CHF) by the fair value at grant (in CHF). After the conclusion of the three-year performance period, the PSUs vest subject to performance and service conditions.

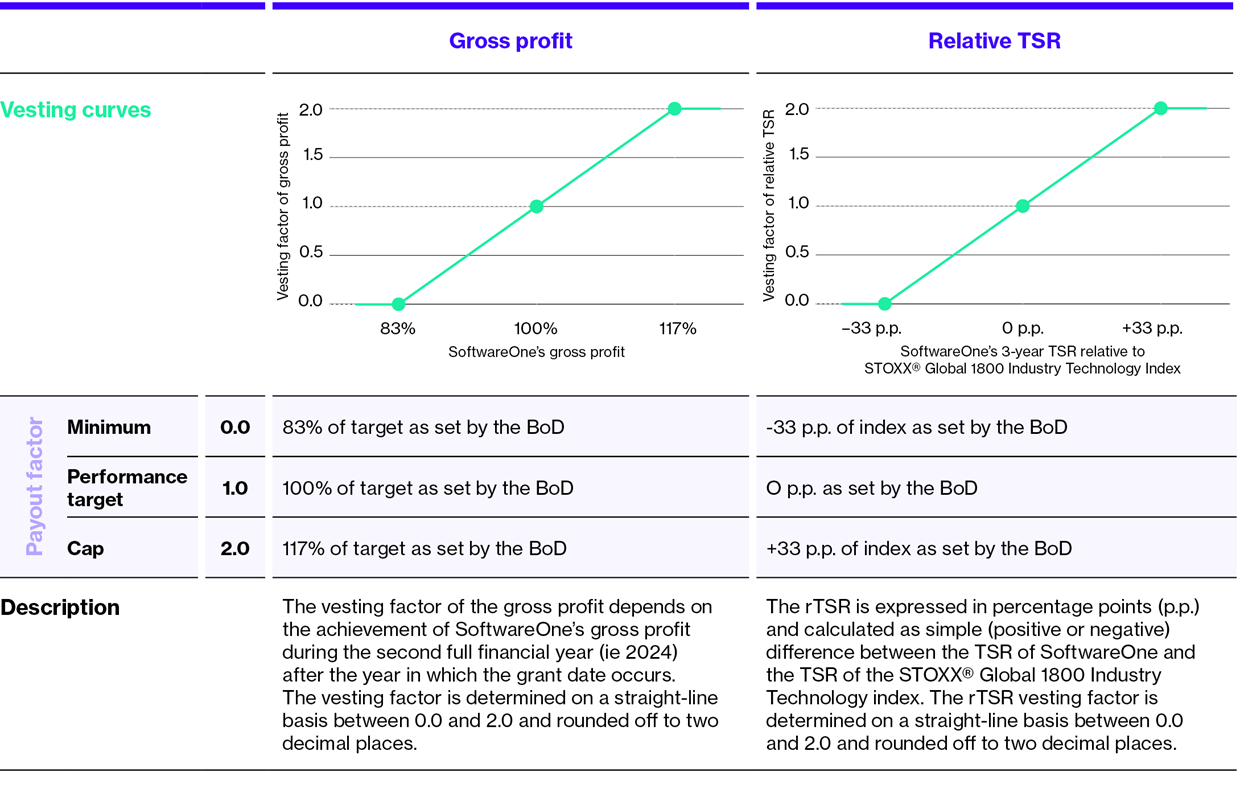

The performance condition is set based on two metrics: gross profit and relative total shareholder return (rTSR). The vesting range lies between 0.0 and 2.0 times the PSUs granted at the outset. While low performance in one performance metric can be balanced by a higher performance in the other metric, the combined vesting multiple can never exceed 2.0. On the contrary, if performance of both metrics remains below the respective minimum performance thresholds, the resulting combined vesting multiple would be 0.0 and consequently no PSUs would vest.

|

LTI performance metrics |

Gross profit |

Relative total shareholder return |

|

Description |

SoftwareOne’s gross profit as disclosed in the financial report |

Total shareholder return (TSR) measured relative to the STOXX ® Global 1800 Industry Technology Index |

|

Weighting |

75 % |

25 % |

|

Performance period |

Second full financial year after the year in which the grant date occurs |

Three consecutive years starting at grant date |

|

Vesting range |

0.0–2.0 times number of PSUs granted |

|

At the beginning of each performance period, the BoD determines the minimum, target and cap for each LTI performance metric upon the NCCs recommendation. The latter is supported by the comprehensive evaluation process, which considers the current strategic performance aspirations and the general market situation. We deem absolute targets for the gross profit metric, commercially sensitive and confidential strategic information and hence disclose these on a relative basis to avoid unfair competitive disadvantage for SoftwareOne. The following illustration outlines the minimum, target and cap for the respective metrics:

Performance metrics illustration

The overall vesting factor is the sum of the weighted vesting factor metrics and determined at the end of the three-year performance period. The NCC proposes and the BoD approves the performance achievement of each metric against the targets originally set as well as the overall vesting factor.

The service condition requires a continuous employment of the plan participant at vesting. In case of termination of employment, none or a reduced number of PSUs vest depending on the conditions of such termination and subject to the applicable law.

As of 2021, a claw back provision, which allows for a partial or full recovery of equity allocated to EB members under the Long-Term Incentive plan was introduced and applies in specific situations which may cause damage to the group or otherwise negatively affect the legitimate interests of SoftwareOne.

In case of a change of control, the LTI plan will terminate with effect from the date of the change of control unless otherwise decided at the discretion of the BoD.

Peer group and benchmarking

Information on peer company compensation is an important point of reference in order to assess the market competitiveness of the compensation awarded to members of the EB. The NCC believes that benchmarking against a consistent and relevant set of peer companies that are similar to SoftwareOne in scope, products and services offered and geographical presence, enables the company to set pay levels towards the middle of the respective market range. This reinforces the talent attraction, motivation and retention efforts needed to support the company’s long-term success.

In this regard, the NCC adopted a comprehensive approach to the peer group construction in March 2020, which led to the compilation of two complementary peer groups: the Swiss Market Index Mid (SMIM) and a peer group of selected European technology companies. The blend of the selected peer companies provides a good balance between the industries and geographies from which key talents are sourced. When setting the EB’s pay levels, the NCC targeted the middle of the respective market ranges.

These constructed peer groups – compiled together with Willis Towers Watson - provide one of the references for a periodic review of EB member compensation in terms of both level and structure.

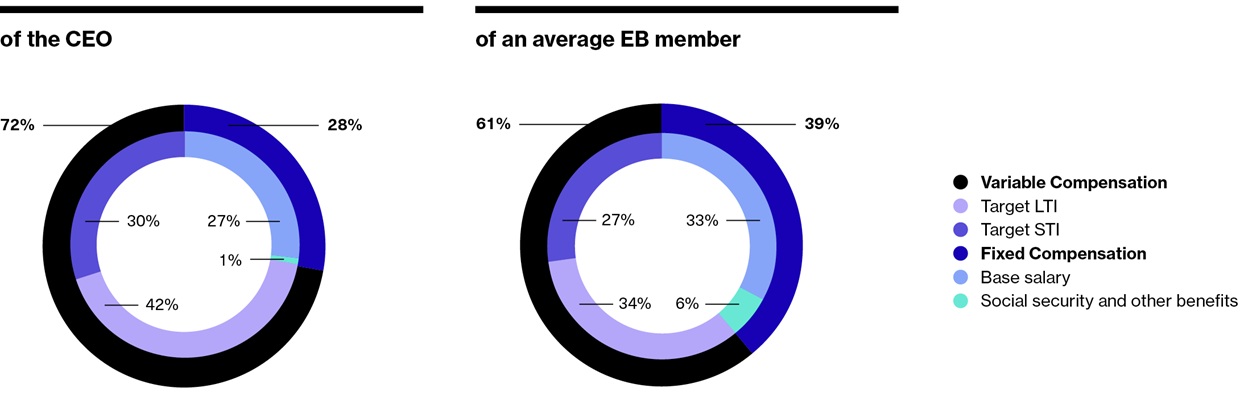

Compensation mix

In 2022, the total target compensation of the CEO was split into around 72% variable compensation and 28% fixed compensation. Of the 72% variable target compensation portion, 30% consisted of the target STI and 42% of the target LTI portion. For other EB members excluding the CEO, the fixed compensation was on average 39% (28% - 43%) and the variable compensation 61% (57% - 72%). The variable target compensation consisted of 27% (25% - 31%) target STI and 34% (32% - 37%) target LTI of total target compensation.

Target compensation mix

Compensation awarded to the EB in 2022

The following table outlines details concerning the compensation awarded to the CEO as the highest paid member of the EB and to the other EB members from 1 January to 31 December 2022. The total compensation awarded in 2021 is also listed.

|

Audited in CHF |

Fixed compensation |

Variable compensation |

Total compensation FY 2022 5) |

Total compensation FY 2021 |

|||

|

Base salary |

Social security contributions |

Other benefits 3) |

Realized STI |

Awarded LTI grant value 4) |

|||

|

|

|

|

|

|

|

|

|

|

Dieter Schlosser, CEO 1) |

769,924 |

9,896 |

8,316 |

635,135 |

1,162,500 |

2,585,771 |

2,174,339 |

|

Aggregate amount of EB members excluding CEO 2) |

2,190,939 |

185,857 |

143,694 |

1,340,221 |

2,251,857 |

6,112,568 |

4,838,413 |

|

|

|

|

|

|

|

|

|

|

Total |

2,960,863 |

195,753 |

152,010 |

1,975,356 |

3,414,357 |

8,698,339 |

7,012,752 |

1) The CEO is compensated in SGD (average exchange rate in 2022 of CHF 1 to SGD 1.443 applied).

2) Please note that of the five EB members, two are compensated in USD (average exchange rate in 2022 of CHF 1 to USD 1.047 applied) and the three other EB members in CHF.

3) Other benefits comprise payments related to additional insurances, car allowance and further benefits granted.

4) The third LTI grant took place in 2022. For details regarding the grant logic and the calculation of the fair value at grant date refer to the financial notes.

5) Numbers for 2021 and until November 2022 are for five EB members, whilst from November 2022 relate to six EB members.

Approved versus total compensation awarded to the EB

The total compensation for the EB for 2022 of CHF 8.7 million (including social security contributions) is below the total maximum aggregate compensation amount of CHF 12 million, which was approved by the AGM in May 2021.

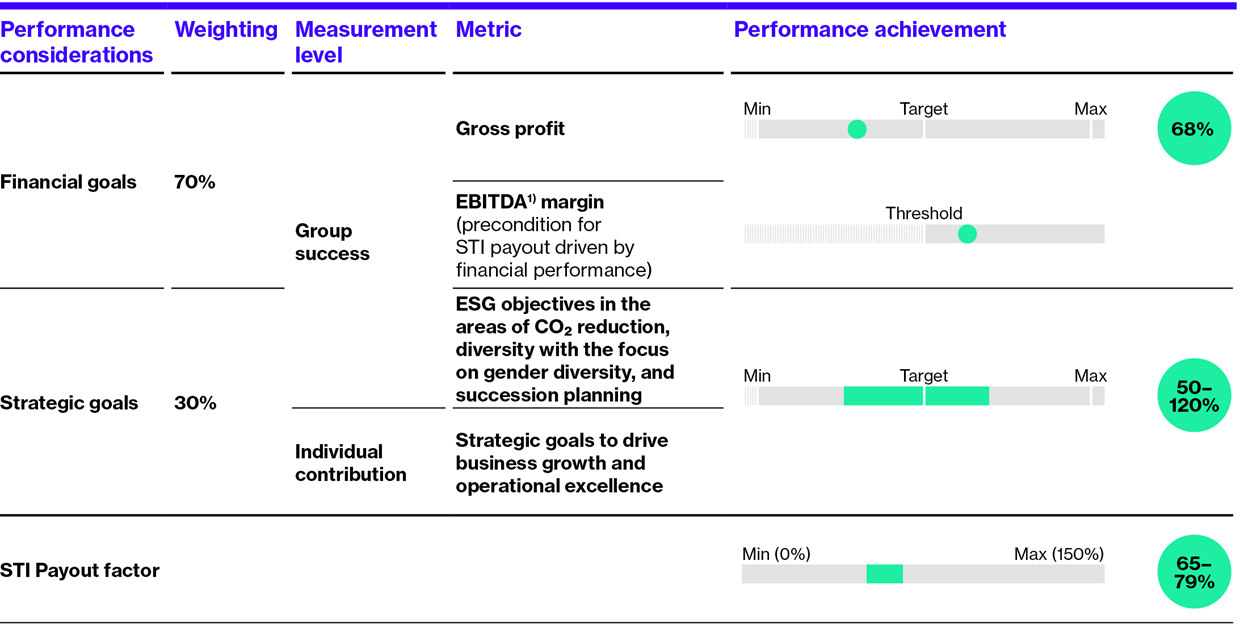

Outcome of the 2022 STI performance achievement

For 2022, the STI performance metrics consisted of the financial (weighted at 70%) and strategic (weighted at 30%) goals. Financial goals were determined based on gross profit and EBITDA margin. Strategic goals comprised ESG objectives in the areas of CO2 reduction, diversity with a focus on gender, succession planning and individual strategic goals to drive business growth and operational excellence tied to each EB member.

In terms of gross profit, growth was 13.8% YoY ccy in 2022, with double-digit growth across all regions. Software & Cloud Services demonstrated continued strong growth, while momentum in Software & Cloud Marketplace improved compared to the prior year. In the context of STI 2022 however, this resulted in the underachievement of the target performance level. Due the level of growth and tight cost control, the adjusted EBITDA margin performance achievement was above the threshold, thus enabling payout of the portion of STI, driven by financial performance.

For 2022, ESG progress was measured in the areas of CO2 reduction, diversity with a focus on gender, and succession planning. During this one-year performance period we achieved measures with the expansion of our MTWO business, an increased gender diversity in our top leadership group and by establishing a succession plan inventory. Overall, the individual contribution of EB members to SoftwareOne's success, as measured by the achievement of strategic goals to drive business growth and operational excellence, was above target. During 2022, we re-aligned our organisational structure including our purpose, vision, strategy, and brand. We successfully initiated our finance and business economics transformation, implemented our digital enterprise change, and adopted and implemented our new business lines Software & Cloud Services and Software & Cloud Marketplace, achieving related development objectives.

Performance achievement across STI goals

The overall 2022 STI performance achievements resulted in the final STI payout factor of 75% for the CEO and 65% - 79% for other full-year EB members. For members of the EB who joined during 2022, the STI performance achievement covers the time period since joining SoftwareOne and, considering the short tenure, is an abbreviated assessment focusing on individual contribution to the company success. No discretionary adjustments have been made regarding the STI 2022.

Outcome of the LTI performance achievement going forward

The first vesting under the current LTI will occur in 2023. Respectively, information regarding the LTI performance achievements and vesting factors will be provided in the Compensation Report 2023 as such information is not available prior to the actual 2023 vesting date.

Share ownership

In 2021, we introduced ownership requirements for the EB members with a five-year build-up period. The minimum shareholding requirement level has been set at 300% and 200% of base salary respectively for the CEO and EB members. We are pleased to report that all EB members present throughout the whole of 2022 have met their build up commitment.

The table below shows the shareholdings of each EB member as of 31 December 2022, considering the number of directly held shares and restricted shares. The total shareholdings as of 31 December 2021 are also listed:

|

Audited EB members |

Number of directly held shares |

Total shareholdings as at 31 December 2022 |

Total shareholdings as at 31 December 2021 |

|

|

Vested shares 1) |

Blocked shares 2) |

|||

|

|

|

|

|

|

|

Dieter Schlosser |

918,788 |

– |

918,788 |

858,788 |

|

Alex Alexandrov |

758,626 |

– |

758,626 |

982,823 |

|

Neil Lomax |

892,948 |

– |

892,948 |

872,948 |

|

Bernd Schlotter |

33,000 |

– |

33,000 |

– |

|

Rodolfo Savitzky |

53,340 |

– |

53,340 |

– |

|

Julia Braun 3) |

– |

– |

– |

– |

|

Hans Grüter 4) |

– |

– |

– |

436,954 |

|

|

|

|

|

|

|

Total |

2,656,702 |

0 |

2,656,702 |

3,151,513 |

1) Also includes shares individually purchased under the ESP.

2) Consisting of MEP restricted shares, subject to staggered restriction periods for a term of three years with early leaver conditions.

3) Julia Braun joined SoftwareOne effective 1 November 2022.

4) Hans Grüter retired from the EB effective 31 December 2021.

Further compensation information

Employment agreements

All members of the EB have employment contract agreements with a six-month notice period, which are governed by the applicable laws. They are not entitled to severance payments.

Their employment agreements also prohibit the EB members from competing against SoftwareOne for a period of up to 12 months after termination of their employment contract. For the specified non-competitive period, SoftwareOne agrees to pay a compensation to the EB member for their compliance with this non-competitive undertaking of an amount equal to 80% of their last base salary (excluding any ancillary benefits and subject to deduction of any social security and further deductions). This is payable in arrears in monthly instalments, for as long as the EB member complies with the non-competitive agreement. However, SoftwareOne may at any time up to two months prior to the last day of employment, waive compliance with the non-competitive agreement whereupon such payments will no longer be due.

Payments to current or former members of the Executive Board

In relation to 2022, payments in the sum of CHF 0.6 million (including social contributions) were made to the former EB member Hans Grueter. No further payments other than those and the ones set out in the compensation table for EB members were made to current or former EB members or 'closely related persons'.

Loans to members of the Executive Board

Article 23 of SoftwareOne’s Articles of Incorporation allow for loans and credits of up to CHF 1 million at market-based conditions to be granted to EB members. In 2022, no loans or credits were made to EB members.