Alternative Performance Measures

SoftwareOne has defined a set of non-IFRS, or alternative, financial measures, which reflect the company’s internal approach to analysing its performance and which are also disclosed externally. These measures allow key decision makers at SoftwareOne to manage the company and make investment decisions. The company believes that such measures are also frequently used by external stakeholders such as sell-side research analysts, investors, and other interested parties to evaluate peers in the same industry.

In 2022, SoftwareOne introduced a new Alternative Performance Measure called 'contribution margin', corresponding to revenue minus delivery costs as part of a new reporting methodology.

In addition, KPIs such as growth and margin will be based on revenue rather than gross profit from 2023 onwards. The use of gross profit will be phased out during the course of 2023.

Results overview

Link to full overview of SoftwareOne's consolidated financial statements

Profit & loss summary – Old reporting methodology

|

|

|

|

|

|

|

|

|

|

IFRS reported |

Adjusted |

||||

|

in CHF million |

2022 |

2021 |

2022 |

2021 |

% Δ |

% Δ at CCY |

|

|

|

|

|

|

|

|

|

Revenue from Software & Cloud Marketplace |

538.4 |

530.2 |

545.3 |

533.6 |

2.2 % |

5.7 % |

|

Gross profit from Software & Cloud Marketplace |

538.4 |

530.2 |

545.3 |

533.6 |

2.2 % |

5.7 % |

|

Revenue from Software & Cloud Services |

465.7 |

384.1 |

465.7 |

384.1 |

21.3 % |

26.0 % |

|

Third party service delivery costs |

–71.5 |

–62.6 |

–71.5 |

–62.6 |

14.2 % |

|

|

Gross profit from Software & Cloud Services |

394.2 |

321.4 |

394.2 |

321.4 |

22.6 % |

27.4 % |

|

Gross profit total |

932.6 |

851.6 |

939.5 |

855.1 |

9.9 % |

13.8 % |

|

Operating expenses |

–795.7 |

–694.7 |

–699.1 |

–635.7 |

10.0 % |

14.5 % |

|

EBITDA |

136.9 |

156.9 |

240.4 |

219.4 |

9.6 % |

11.9 % |

|

Depreciation, amortisation and impairment 1) |

–58.6 |

–55.3 |

–58.6 |

–55.3 |

5.8 % |

|

|

EBIT |

78.4 |

101.6 |

181.9 |

164.1 |

10.9 % |

– |

|

Net financial items |

–92.4 |

49.4 |

–14.7 |

–14.0 |

5.3 % |

– |

|

Earnings before tax |

–14.0 |

151.0 |

167.2 |

150.1 |

11.4 % |

– |

|

Income tax expense |

–44.3 |

–33.3 |

–52.2 |

–40.1 |

30.1 % |

– |

|

Profit for the year |

–58.3 |

117.6 |

115.0 |

110.0 |

4.6 % |

– |

|

|

|

|

|

|

|

|

|

EBITDA margin (% gross profit) |

14.7 % |

18.4 % |

25.6 % |

25.7 % |

-0.1pp |

– |

|

EPS (diluted) |

–0.38 |

0.76 |

0.74 |

0.71 |

4.4 % |

– |

1) Includes PPA amortization (including impairments, if applicable) of CHF 15.9 million and CHF 14.4 million in 2022 and 2021, respectively

Profit & loss summary – New reporting methodology

|

|

|

|

|

|

|

|

Adjusted |

|||

|

in CHF million |

2022 |

2021 |

% Δ |

% Δ at CCY |

|

|

|

|

|

|

|

Revenue from Software & Cloud Marketplace |

545.3 |

533.6 |

2.2 % |

5.7 % |

|

Revenue from Software & Cloud Services |

465.7 |

384.1 |

21.3 % |

26.0 % |

|

Total revenue |

1,011.0 |

917.7 |

10.2 % |

14.1 % |

|

Delivery costs |

–374.6 |

–322.6 |

16.1 % |

20.7 % |

|

Contribution margin |

636.4 |

595.1 |

6.9 % |

10.9 % |

|

SG&A |

–396.0 |

–375.7 |

5.4 % |

9.9 % |

|

EBITDA |

240.4 |

219.4 |

9.6 % |

11.9 % |

|

Depreciation, amortisation and impairment 1) |

–58.6 |

–55.3 |

5.8 % |

– |

|

EBIT |

181.9 |

164.1 |

10.9 % |

– |

|

Net financial items |

–14.7 |

–14.0 |

5.3 % |

– |

|

Earnings before tax |

167.2 |

150.1 |

11.4 % |

– |

|

Income tax expense |

–52.2 |

–40.1 |

30.1 % |

– |

|

Profit for the year |

115.0 |

110.0 |

4.6 % |

– |

|

|

|

|

|

|

|

EBITDA margin (% revenue) |

23.8 % |

23.9 % |

-0.1pp |

– |

|

EPS (diluted) |

0.74 |

0.71 |

4.4 % |

– |

1) Includes PPA amortisation (including impairments, if applicable) of CHF 15.9 million and CHF 14.4 million in 2022 and 2021, respectively

Reconciliation – IFRS reported to Adjusted profit

|

in CHF million |

2022 |

2021 |

|

|

|

|

|

IFRS reported profit for the period |

–58.3 |

117.6 |

|

Impact of change in revenue recognition of Microsoft Enterprise Agreements |

6.6 |

3.3 |

|

Share-based compensation |

4.3 |

13.2 |

|

Integration expenses, M&A and earn-out expenses |

44.3 |

36.7 |

|

Restructuring expenses |

13.1 |

9.3 |

|

Russia related-loss |

35.2 |

– |

|

Total revenue and operating expense adjustments |

103.5 |

62.5 |

|

Depreciation / (appreciation) of Crayon and impact of adjustments on financial result |

77.7 |

–63.4 |

|

Tax impact of adjustments |

–7.9 |

–6.8 |

|

Adjusted profit for the year |

115.0 |

110.0 |

Source: Management view

Non-IFRS financial measures and group key performance indicators (KPIs)

The group presents non-IFRS financial measures used by management to monitor the company’s performance, which may be helpful for external stakeholders in evaluating SoftwareOne’s financial results compared to industry peers. They include the following:

Gross profit from Software & Cloud Marketplace equals revenue from the sale of software and cloud. Gross profit from Software & Cloud Services is calculated as revenue from solutions and services less third-party service delivery costs.

Adjusted EBITDA is defined as the underlying earnings before net financial items, tax, depreciation and amortisation, adjusted for items affecting comparability in operating expenses.

Adjusted EBITDA margin is defined as adjusted EBITDA divided by gross profit (old reporting methodology) or revenue (new reporting methodology).

Adjusted profit for the period is defined as the (loss)/profit for the period, adjusted for items impacting comparability in operating expenses and net finance income/(expenses) as well as the related tax impact.

Contribution margin is defined as total revenue net of third-party service delivery costs and directly attributable internal delivery costs.

Free cash flow is defined as the group net cash generated from/(used in) operating activities, plus net cash from/(used in) investing activities, minus net cash from acquisition of businesses (net of cash acquired), sale of subsidiary (net of cash disposed) and proceeds from sale of financial assets.

Growth at constant currencies is defined as the change between two periods presented on a constant currency basis for comparability purposes and to assess the group’s underlying performance. Period profit and loss figures are translated from the subsidiaries’ respective local currencies into Swiss francs at the applicable average exchange rate of the prior year period. This calculation is based on the underlying management accounts.

Net debt / cash comprises the group’s cash and cash equivalents, current financial assets and other non-current receivables less bank overdrafts, contingent consideration liabilities, lease liabilities, other current and non-current financial liabilities.

Net working capital is defined as the group’s trade receivables, current other receivables, prepayments and contract assets minus trade payables, current other payables and accrued expenses and contract liabilities.

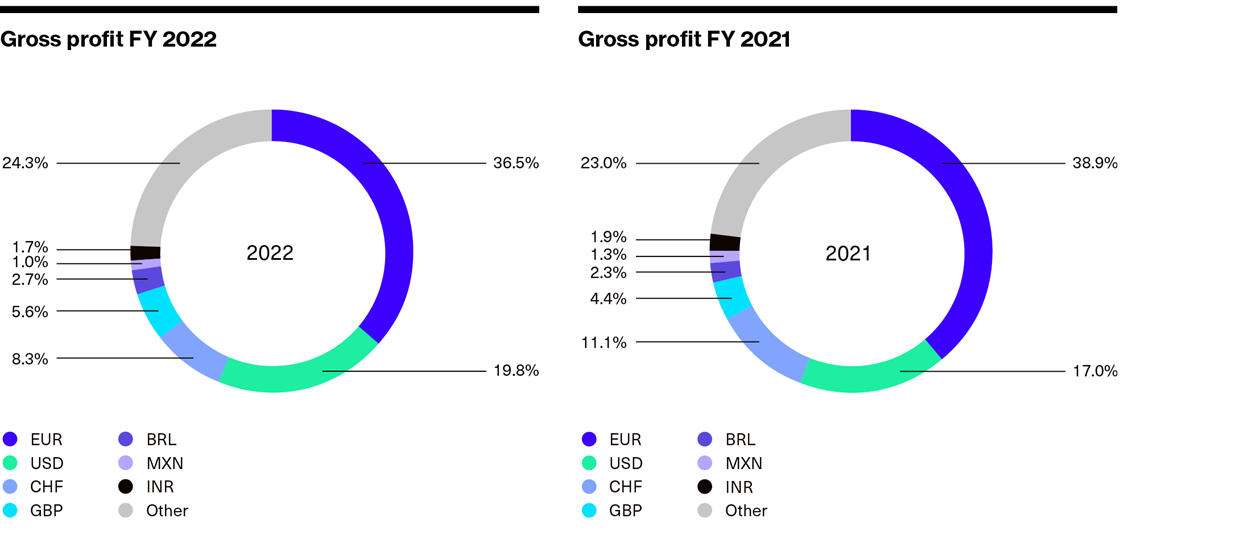

Exchange rates

The table below shows the development of the Swiss franc, SoftwareOne's reporting currency, against major currencies. In addition, the charts provide an overview of the currency breakdowns, including currencies which had the biggest impact on gross profit and operating expenses during 2022. Related calculations are based on underlying management accounts and may slightly differ from exchange rates shown in the Consolidated financial statements.

|

CHF to LCY |

2022 |

2021 |

% change |

|

|

|

|

|

|

EUR |

1.00 |

0.93 |

7.4 % |

|

USD |

1.05 |

1.09 |

–4.3 % |

|

CHF |

1.00 |

1.00 |

0.0 % |

|

GBP |

0.85 |

0.80 |

6.6 % |

|

BRL |

5.40 |

5.87 |

–8.0 % |

|

MXN |

21.15 |

22.20 |

–4.8 % |

|

INR |

82.21 |

80.86 |

1.7 % |

FX exposure

Source: Based on management accounts