Alternative Performance Measures

SoftwareONE has defined a set of non-IFRS financial measures, which reflect the company’s internal approach to analyzing the results and which are disclosed externally. They provide key decision makers at SoftwareONE with the necessary guidance on managing the group and making investment decisions, and serve as a benchmark to recognize if the company is making progress with the implementation of its vision. The company believes that such measures are frequently used by external stakeholders such as sell-side analysts, investors and other interested parties to evaluate companies in the same industry.

Reconciliation from IFRS reported to adjusted profit and loss statement

Results overview

Link to full overview of SoftwareONE's consolidated financial statements

Reported and adjusted profit and loss statement

|

|

|

|

|

|

|

|

|

|

|

|

|

IFRS reported |

Adjustments |

Adjusted |

% Δ |

% Δ at CCY 1 |

||||

|

in CHF million (unless otherwise indicated) |

H1 2020 |

H1 2019 |

H1 2020 Other adj. |

H1 2019 Adding CPX |

H1 2019 Other adj. |

H1 2020 |

H1 2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from sale of software and other revenue |

3,941.2 |

3,730.3 |

– |

230.4 |

– |

3,941.2 |

3,960.7 |

–0.5 % |

5.4 % |

|

Cost of software purchased 2 |

–3,666.5 |

–3,464.3 |

– |

–208.9 |

2.2 |

–3,666.5 |

–3,671.0 |

–0.1 % |

|

|

Gross profit from sale of software and other revenue |

274.6 |

266.0 |

– |

21.5 |

2.2 |

274.6 |

289.7 |

–5.2 % |

0.9 % |

|

Revenue from solutions and services |

145.9 |

170.0 |

– |

18.7 |

– |

145.9 |

188.7 |

–22.7 % |

–15.9 % |

|

Third-party service delivery costs |

–49.8 |

–87.2 |

– |

–12.1 |

– |

–49.8 |

–99.4 |

–49.9 % |

|

|

Gross profit from solutions and services |

96.2 |

82.8 |

– |

6.5 |

– |

96.2 |

89.4 |

7.6 % |

15.1 % |

|

Gross profit total |

370.8 |

348.8 |

– |

28.0 |

2.2 |

370.8 |

379.0 |

–2.2 % |

4.3 % |

|

Personnel expenses |

–231.1 |

–208.5 |

15.8 |

–18.2 |

1.2 |

–215.3 |

–225.5 |

–4.5 % |

2.1 % |

|

Other operating expenses |

–44.7 |

–50.8 |

3.4 |

–4.5 |

1.6 |

–41.3 |

–53.7 |

–23.2 % |

–17.5 % |

|

Other operating income |

7.3 |

5.5 |

–1.5 |

2.2 |

– |

5.8 |

7.6 |

–24.0 % |

–18.3 % |

|

Operating expenses |

–268.5 |

–253.8 |

17.7 |

–20.5 |

2.7 |

–250.8 |

–271.6 |

–7.7 % |

–1.2 % |

|

EBITDA |

102.3 |

95.0 |

17.7 |

7.5 |

4.9 |

120.0 |

107.4 |

11.7 % |

18.2 % |

|

Depreciation & amortization 3 |

–29.7 |

–24.1 |

– |

–1.0 |

– |

–29.7 |

–25.1 |

18.4 % |

|

|

EBIT |

72.6 |

70.9 |

17.7 |

6.5 |

4.9 |

90.3 |

82.4 |

9.7 % |

|

|

Finance income |

21.5 |

18.8 |

–13.3 |

0.1 |

–11.5 |

8.2 |

7.3 |

11.5 % |

|

|

Finance costs |

–4.4 |

–5.6 |

– |

–0.8 |

– |

–4.4 |

–6.5 |

–31.9 % |

|

|

Foreign exchange difference, net |

–5.9 |

–2.3 |

– |

–0.4 |

– |

–5.9 |

–2.7 |

120.6 % |

|

|

Share of result of joint ventures and associates |

0.4 |

– |

– |

– |

– |

0.4 |

– |

– |

|

|

Net financial items |

11.6 |

10.9 |

–13.3 |

–1.1 |

–11.5 |

–1.7 |

–1.8 |

–5.6 % |

|

|

Earnings before income tax |

84.2 |

81.8 |

4.4 |

5.4 |

–6.6 |

88.6 |

80.5 |

10.0 % |

|

|

Income tax expense |

–17.5 |

–14.5 |

–3.2 |

0.3 |

–0.6 |

–20.8 |

–14.9 |

39.4 % |

|

|

Profit for the period |

66.7 |

67.3 |

1.2 |

5.7 |

–7.3 |

67.9 |

65.6 |

3.4 % |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA margin (%) |

27.6 % |

27.2 % |

|

|

|

32.4 % |

28.3 % |

4.0 pp |

|

|

EPS |

0.43 |

0.45 |

|

|

|

0.44 |

0.44 |

0.6 % |

|

1) In constant currency

2) Includes reclassification of bad debt from gross profit to operating expenses of CHF 2.2 million in H1 2019

3) Includes PPA amortization (including impairments) of CHF 10.7 million and CHF 5.5 million in H1 2020 and H1 2019, respectively

Adjustments

|

in CHF million |

H1 2020 |

H1 2019 |

|

|

|

|

|

IFRS reported profit for the period |

66.7 |

67.3 |

|

Proforma adjustments for Comparex acquisition (adding January 2019) |

– |

5.7 |

|

Certain share-based compensation 1 |

12.4 |

– |

|

IPO, integration and M&A and earn-out expenses |

5.3 |

4.9 |

|

Total operating expense adjustments |

17.7 |

4.9 |

|

Depreciation / (appreciation) of Crayon shareholding |

–13.3 |

–11.5 |

|

Tax impact on adjustments |

–3.2 |

–0.6 |

|

Adjusted profit for the period |

67.9 |

65.6 |

1) Relate to management equity plan and free share grant to employees

Adjustments related to Comparex acquisition for H1 2019

SoftwareONE has prepared a selection of unaudited adjusted financial information for the six months ended 30 June 2019 to illustrate the effect of the Comparex acquisition on its consolidated income statement by giving effect to the transaction as if it had been completed on 1 January 2019, including accouting policy aligment, reclassification and currency translations. For the first half of 2019, this includes audited IFRS reported numbers 2019 (six months SoftwareONE and five months Comparex) and the month of January 2019 of Comparex. On a profit for the period level, these proforma adjustments totaled CHF 5.7 million in H1 2019.

Other adjustments

Other adjustments include the following items:

- Certain share-based compensation, including management equity plan expenses in connection with the IPO; these are fully funded by major shareholders with no equity impact and free share grants to employees (see Note 8 of the financial statements)

- Costs relating to integrating acquired companies

- M&A-related third-party costs and earn-out expenses

- Depreciation / (appreciation) of Crayon shareholding

- Tax impact on adjustments

- In the past, SoftwareONE presented the bad debt provision as cost of software in the adjusted figures. In line with IFRS, bad debt provisions are now presented as operating expenses since the beginning of this year. For H1 2019, CHF 2.2 million of bad debt provision has been reclassified from cost of software to operating expenses. Bad debt provision in H1 2020 was CHF 6.0 million.

Non-IFRS financial measures and group key performance indicators (KPIs)

The group presents non-IFRS financial measures because they are used by management to monitor the business performance and as they might be helpful for external stakeholders to evaluate SoftwareONE’s financial results compared to other companies in the same industry. They include the following:

Gross profit from sale of software and other revenue is the sum of revenue from the sale of software and other revenue less cost of software purchased. Gross profit from solutions and services is calculated as revenue from solutions and services less third-party service delivery costs. The total gross profit helps as a KPI to manage and monitor SoftwareONE’s business as well as for incentivizing the sales force.

Adjusted EBITDA is defined as the underlying earnings before net financial items, tax, depreciation and amortization excluding the effects of adjustments in operating expenses.

Adjusted EBITDA margin is defined as adjusted EBITDA divided by gross profit.

Adjusted profit for the period is defined as the profit for the period excluding the effects of adjustments in operating expenses as well as on net financial income / (expenses) and related tax impacts.

Growth at constant currencies: The change between two periods is presented on a constant currency basis for comparability purposes and to assess the group's underlying performance. Current period profit and loss figures are translated from the subsidiaries’ respective local currencies into Swiss francs at the applicable average exchange rate of the prior-year period. This calculation is based on the underlying management accounts.

Net debt/(cash) comprises the group’s cash and cash equivalents, financial assets and long-term other receivables less bank overdrafts, contingent consideration liabilities, lease liabilities, other current and non current financial liabilities and any open payments related to the management equity plan.

Net working capital is defined as the group’s trade receivables, other receivables, prepayments and contract assets minus trade payables, other payables and accrued expenses and contract liabilities (excluding any open payments related to the management equity plan).

Free cash flow is defined as the group net cash generated from/(used in) operating activities plus cash from/(used in) acquisitions of businesses (net of cash balance).

Exchange rates

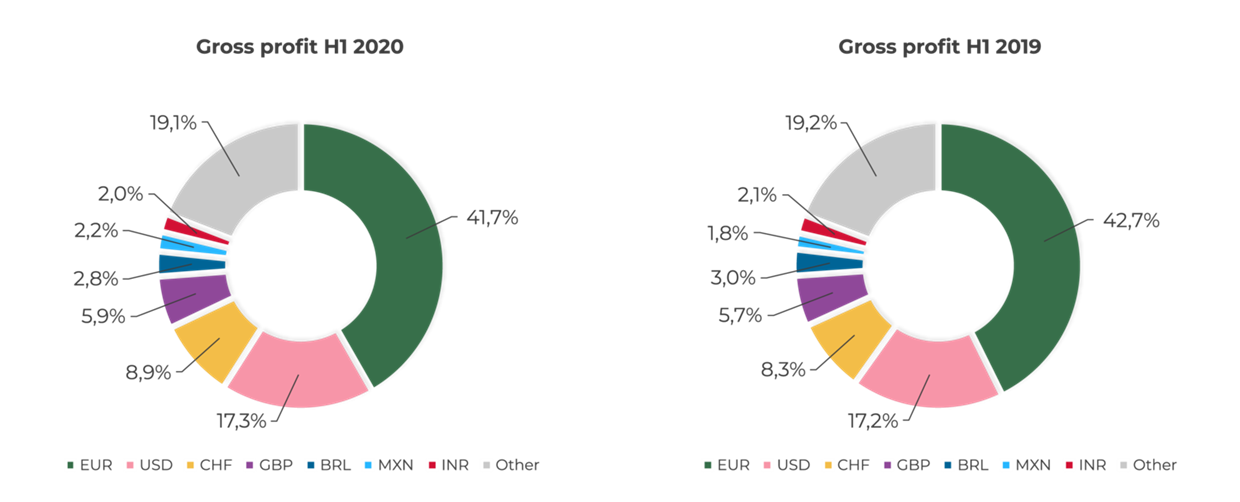

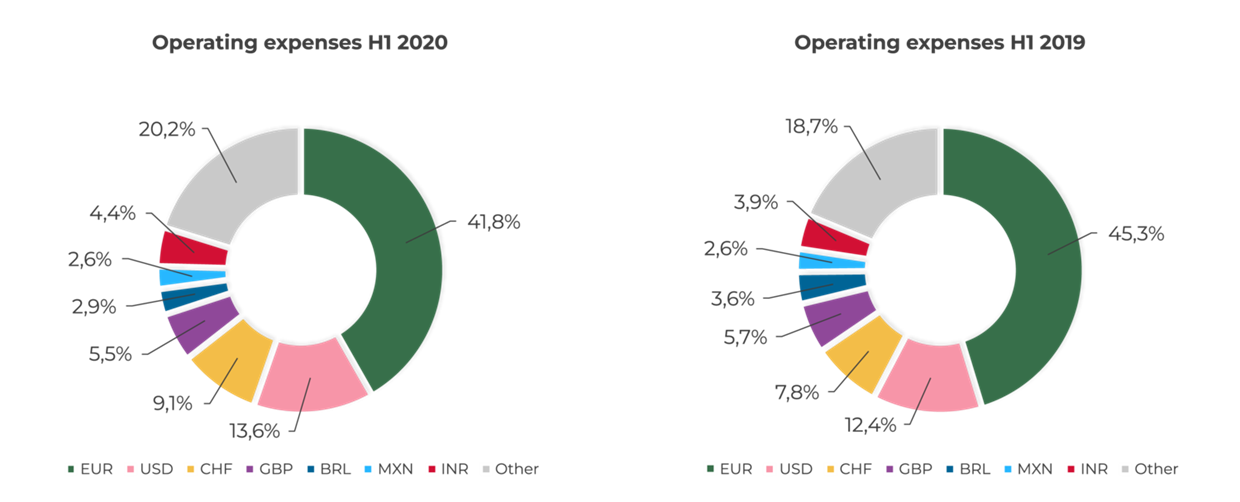

The table below shows the development of the Swiss franc, SoftwareONE's reporting currency, against major local currencies between two periods, and the charts provide an overview of the currency splits for gross profit and operating expenses. Related calculations are based on underlying management accounts.

|

CHF to LCY |

H1 2020 |

H1 2019 |

% change |

|

|

|

|

|

|

EUR |

0.94 |

0.89 |

6.0 % |

|

USD |

1.04 |

1.00 |

3.8 % |

|

CHF |

1.00 |

1.00 |

0.0 % |

|

GBP |

0.83 |

0.77 |

7.0 % |

|

BRL |

5.01 |

3.84 |

30.4 % |

|

MXN |

22.69 |

19.25 |

17.9 % |

|

INR |

77.75 |

69.83 |

11.3 % |